Exploring the Differences Between MetaTrader 4 and MetaTrader 5: A Comprehensive Comparison

In this article, we will look at the differences between two trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Please be advised that our Client Portal is scheduled for essential maintenance this weekend from market close on Friday 5th April, 2024, and should be back up and running before markets open on Sunday 7th April, 2024.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

In this article, we will look at the differences between two trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Understand gearing ratio, a critical metric for traders evaluating leverage and risk. Learn how to calculate gearing, interpret healthy vs. risky levels, and use it to make informed trading decisions. Get insights on optimal gearing for different strategies and assets.

Discover the thrilling world of Boom & Crash indices trading. Master volatile markets with proven strategies for capitalizing on rapid price spikes and crashes.

Use this 20-point checklist to evaluate whether the broker you choose to trade with is safe… or a scam.

2024 Commodity Outlook: Expectations for Oil, Gas, Metals, and Agriculture. Get insider analysis on key factors impacting commodity prices like the Ukraine war, El Niño, Chinese economy, and more. Explore forecasts for gold, copper, natural gas, agricultural commodities, and other major trading instruments.

In this article, we’ll explore the exciting world of bullish and bearish markets. Whether you’re a seasoned trader or just starting, understanding these market dynamics is crucial for success. So, buckle up and let’s dive in!

This article provides an overview of exit strategies in trading and why they are essential for long-term success.

Here’s a look at the top 4 currency pairs that were most commonly traded in 2023: XAUUSD, EURUSD, USDJPY and GBPUSD.

In this article, we unravel the world of swaps in trading: factors influencing the size of a swap to navigating the realm of positive and negative swaps.

In this article, we look at the Elliott Wave theory and how it can help analyse markets to anticipate price fluctuations by observing and recognising recurrent wave patterns.

Whether you are a novice or an experienced trader, the knowledge within these books is a valuable resource for navigating the complexities of the financial markets.

This article will look into the top strongest currencies and how they fit into the ever-changing global financial landscape.

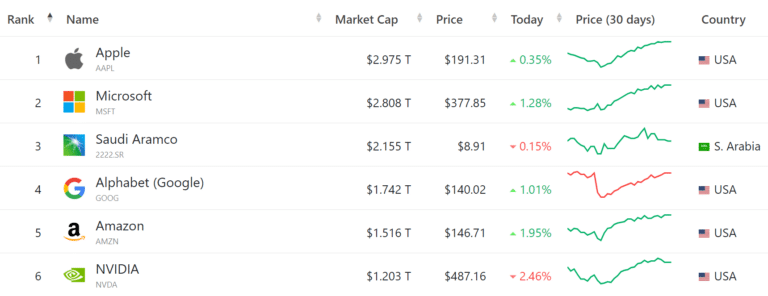

In this post, we explore the largest companies in the world that currently boast a market capitalization of over $1 trillion.

By understanding common scam tactics and following the tips outlined in this article, you can protect yourself from falling victim to fraudulent schemes and become a more informed trader.

This article aims to be your guiding light through this sea of choices, helping you make an informed decision that aligns with your unique needs and goals.

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Please click here to view our Risk Disclosure.

Hantec Markets use cookies to enhance your experience on our website. By staying on our website you agree to our use of cookies.

You can access our Cookie Policy here

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Please click here to view our Risk Disclosure.

Hantec Markets use cookies to enhance your experience on our website. By staying on our website you agree to our use of cookies. You can access our Cookie Policy here

Hantec Markets is a trading name of Hantec Group.

This website is owned and operated by Hantec Markets Holdings Limited. Hantec Markets Holdings Limited is the holding company of Hantec Markets Limited and Hantec Markets Ltd.

Hantec Markets Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the UK (Register no: FRN 502635).

Hantec Markets Ltd. is authorised and regulated as an Investment Dealer by The Financial Services Commission of Mauritius (License no: C114013940).

The services of Hantec Markets and information on this website are not aimed at residents of certain jurisdictions, and are not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use may be contrary to any of the laws or regulations of that jurisdiction. The products and services described herein may not be available in all countries and jurisdictions. Those who access this site do so on their own initiative, and are therefore responsible for compliance with applicable local laws and regulations. The release does not constitute any invitation or recruitment of business.

Hantec Markets does not offer its services to residents of certain jurisdictions including USA, Iran, Myanmar and North Korea.

We are transferring you to our affiliated company Hantec Trader.

Please note: Hantec Trader does not accept customers from the USA or other restricted countries.