What is Spot Trading? Examples, Advantages and Disadvantages

There are multiple different ways a trader can go about their business in order to make money, all of which are vital to understanding if one is to become successful. In this article, we will focus on spot trading, looking at examples, and alternative options, along with the advantages and disadvantages of the process.

We are going to look at the following:

How Spot Trading Works

First of all, we must understand what spot trading is and how we use it. The defining feature of spot trading is that the assets involved in the trade are delivered immediately to the buyer. The assets are purchased at the current market price, also known as the spot price, making this a very simple form of trading that is accessible to traders of all levels. Spot trading is often considered the quickest way of trading equity, foreign exchange, commodities and other financial assets, which is very appealing for day traders. Trader would use spot trading when they anticipate that the price of the asset they purchase will increase, so they can sell it in the future for a profit. Traders can also perform short trading in the spot market if they anticipate the price of an asset will fall. Naturally, this means the three key concepts of spot trading are the spot price, trade date and settlement date. As with all trading, profits are not guaranteed, and losses can occur if the asset price diminishes or rises, contrary to the direction of the trade.

There are two main types of spot trading, over-the-counter (OTC) markets and organised market exchange. Market exchange is probably the more familiar of the two, with an organised marketplace available to trade financial assets, such as the New York Stock Exchange (NYSE).

Nowadays, this is mainly performed by electronic trading platforms, as opposed to on a trading floor, allowing huge numbers of trades to be performed simultaneously with instantaneous prices being set. OTC is different in that there is no third-party regulator, and buyers and sellers enter into a mutual bilateral agreement. Prices and quantities can differ from those typically traded on exchanges, with a level of privacy involved, meaning prices are often not disclosed.

Spot Trading Example

Spot trading is a basic and popular way to trade, and with Hantec, you can trade the spot markets via CFDs. You do not actually take ownership of the assets, but you do benefit from real-time pricing that echoes the primary market. Furthermore, you can open a position using margin, which raises market exposure, potentially leading to larger profits, but this can also lead to bigger losses.

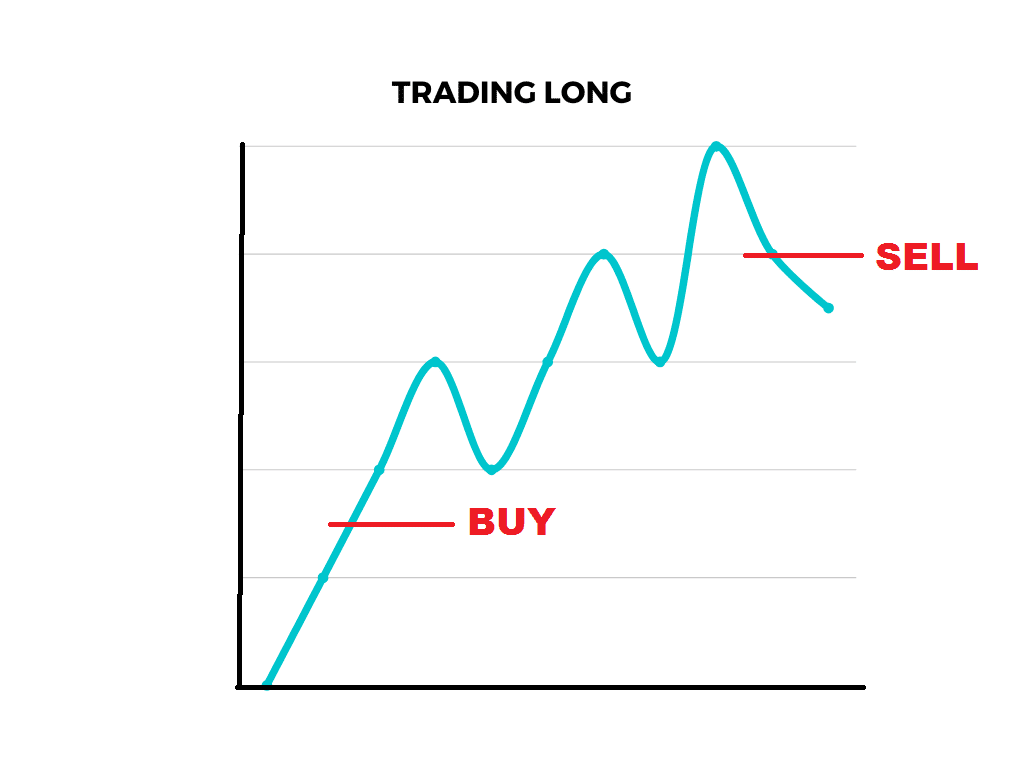

Let's look at an example. Say you believe the price of Gold is going to rise, so you buy the gold market (you go long). If the price is gold rises, you make a profit, and if it falls, you make a loss.

What Spot Trading is NOT (Forwards and Futures)

Forwards and futures contracts are another way to trade, which differs from spot trading in that they are an agreement to buy or sell an asset at a certain date in the future as opposed to the transaction being complete immediately. There are a few differences between forwards and futures contracts. Futures contracts are traded on exchanges, with standardised contracts, with uniform terms. They are marked to market on a daily basis, then settled at the end of the contract and come with little default risk, as payment is guaranteed on the maturity date by the exchange.

Forward contracts are made over the counter, so all terms are negotiated between the two parties and are only settled at the end of the contract. This means the contracts have more flexible terms and conditions, such as the number of units of the asset traded. Forward contracts are often used by companies to hedge against risk and volatility. With a forward contract, the seller is protected against the asset falling in price. However, it comes with a certain level of default risk, as payments are the responsibility of the counterparty, so if a party defaults, payment is not guaranteed until the maturity date.

Advantages of Spot Trading

There are multiple advantages of spot trading compared to other types of trading, such as futures and forward contracts.

There is a higher level of transparency with spot markets, as all transactions and prices are available to the public. This means transactions can be performed with confidence.

Spot trading also provides extra flexibility for the trader to hold onto their investment if markets do not move immediately as predicted. With futures and forwards, the trader is somewhat confined by the future delivery/ settlement date.

Disadvantages of Spot Trading

Despite spot trading's advantages, its structure does have its limitations. One such limitation is its inability to hedge against the consumption and production of future goods in order to reduce the risk of volatility in the market. This is especially prevalent in the agricultural goods market and the foreign exchange market, where forward and future contracts are often used.

Planning is also harder and less thorough in spot trading. In futures and forward markets, all aspects of the contract are agreed upon, whereas some spot markets can be affected by counterparty default risk.

It can also be argued spot trading is risky. A trader may invest when the price of an asset is inflated, leading to smaller profits or losses. This is largely caused by the volatility of commodities and financial instruments, leading to increased risk. However, it can be argued there is an opportunity cost if the prices moves the wrong way once you have made a future or forward contract.

In the CFD space, on spot trading positions, one must pay the overnight funding rate, also known as the 'Swap' charge. This is the cost of holding a position overnight, and the amount will be dependent on whether you have a long or short position, the instrument you are trading and the size of your trade. Swap rates are calculated from the underlying interest rate of the asset or currency pairs you have open positions in. So, if you are going to hold a

trade overnight and longer than a few days, you will rack up swap fees on spot CFD positions.

Therefore, if you are going to hold longer-term trades for more than a few days, it may be worth trading the CFD future. If you trade the future, the swap fees are included in the spread (which is wider than the spot spread), and it may be less expensive in terms of fees to hold a CFD future position than the equivalent spot position if you are trading over longer timeframes.

Spot Trading Takeaways

Spot trading is a safe and common way for traders and investors to be involved in a multitude of different financial markets and asset classes. And with Hantec, you can trade many of these differing spot markets through CFDs, including individual stocks, foreign exchange, equity indices, and commodities, including Gold, Silver, Oil and many more. So, why not open an account today?

Top 5 Blogs

Balance Guard

Balance Guard