Your Ultimate Guide to Trading Synthetic Indices in 2025

Have you ever wished you could trade the financial markets without worrying about surprise news events or waiting for markets to open? Welcome to the world of synthetic indices trading. These unique financial instruments offer a way to engage with market dynamics 24/7, providing a dynamic trading environment completely separate from the real world.

If you're looking to start trading synthetic indices, this guide will walk you through everything you need to know. We'll cover what they are, how they work, and the effective trading strategies you can use to navigate these simulated markets.

Table of Contents:

How Are Synthetic Indices Created?

At their core, synthetic indices are products of a sophisticated algorithm, not underlying assets. The process begins with a cryptographically secure random number generator. This ensures the initial data is completely unpredictable.

This stream of random numbers is then processed by an algorithm designed to replicate realistic market behaviours and price movements. It creates charts that look and feel like those of actual markets, complete with trends, ranges, and market volatility. The crucial difference is that their price behaviour is not influenced by global events, economic data releases, or political news, which heavily impact traditional markets.

The Most Popular Synthetic Indices to Trade

There are many different synthetic indices available, each with a unique personality. Choosing the right one often depends on your trading style and risk appetite. Here are some of the most popular synthetic indices:

- Volatility Indices (V-Indices): The star of this category is the Volatility 75 Index. As a type of synthetic volatility index, it’s known for its high, constant volatility, leading to rapid price changes and significant price movements. It's a favourite among traders who thrive on action, though it requires robust risk management.

- Boom and Crash Indices: These trading instruments are programmed with a specific quirk.

Boom indices and Crash indices (like Boom 500 or Crash 1000) are characterised by their unique price action of small ticks followed by a sudden spike or drop.

Jump Indices: These indices have a fixed probability of upward or downward "jumps," disrupting a steady trend at regular intervals.

Synthetic vs. Traditional Indices: A Head-to-Head Comparison

Understanding the differences between synthetic markets and traditional markets is key to success. Unlike traditional indices, which track stock indices like the NASDAQ or the performance of different asset classes, synthetic indices stand alone.

Here’s a breakdown of how they compare:

| Feature | Synthetic Indices | Traditional Indices (e.g., S&P 500) |

|---|---|---|

| Price Driver | A secure algorithm. | Performance of real companies and underlying assets. |

| Market Influence | Unaffected by news, politics, or market sentiment. | Directly affected by economic data, commodity prices, and global news. |

| Market Availability | Trade 24/7/365, with no fixed market hours. | Limited to the opening hours of global stock exchanges. |

| Analysis Type | Relies purely on technical analysis of historical price data. | Requires both technical analysis and fundamental analysis. |

This immunity from external factors means traders can't gauge market sentiment from news headlines; instead, they must focus entirely on what the charts are telling them. This provides a pure trading experience based on market dynamics.

Top Synthetic Indices Trading Strategies

To make informed trading decisions, you need a solid plan. Because you can't rely on fundamental analysis, your success hinges on mastering technical analysis tools and strategies. Here are a few proven synthetic indices trading strategies:

- Trend Following Strategies: This is one of the most popular approaches. The goal is to identify trends in the market's direction and trade with the market momentum. Traders use technical indicators like Moving Averages or the RSI to confirm whether the market is in an uptrend or downtrend and then place trades accordingly.

- Range Trading:When an index is moving sideways between a clear ceiling (resistance) and floor (support), you can trade the range. The strategy is simple: buy near the support level and sell near the resistance level.

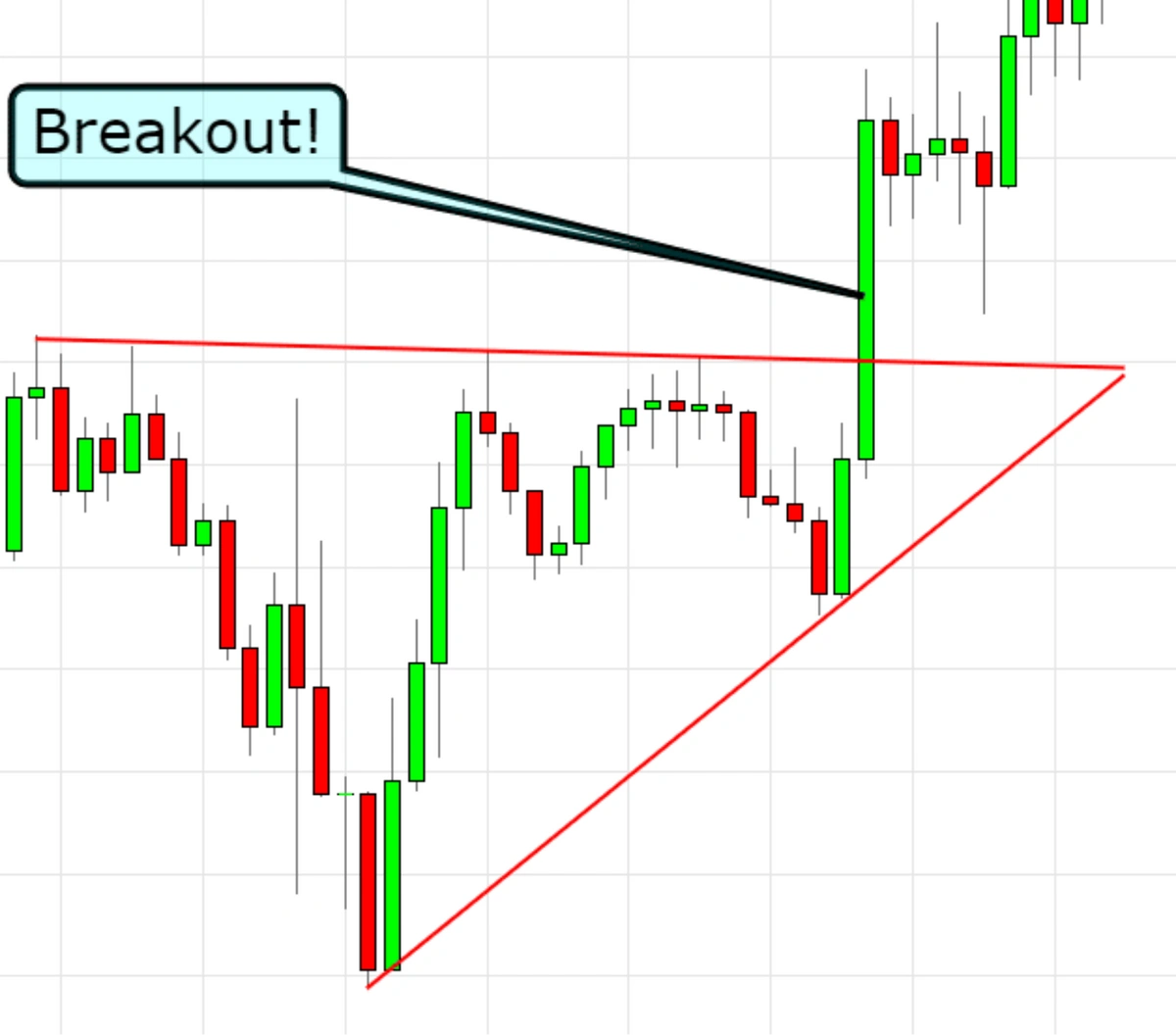

- Breakout Trading: A breakout happens when the price pushes through a key level of support or resistance, often leading to significant price movements. This strategy is designed to catch the beginning of a potential new trend.

A Simulated Trade Example: Putting It All Together

Let's imagine a trading scenario on the Volatility 75 Index to see how these concepts work in practice.

Let's say you decide to buy 0.2 lots of V75 at a price of 500,000.

- Entry & Analysis: After analysing the chart, you believe an uptrend is forming. You open a buy position.

- Risk Management: You set a Stop-Loss at 498,000 to limit your potential loss and a Take-Profit at 506,000 to lock in profits.

- Risk-to-Reward Ratio: Your risk is 2,000 points (500,000−498,000). Your potential reward is 6,000 points (506,000−500,000). This gives you a healthy 1:3 risk-to-reward ratio.

- Outcome: The market rallies, and your take-profit order is triggered.

- Profit Calculation: Assuming a point value of $0.20 for your lot size, your profit is 6,000×$0.20=$1,200.

How to Start Trading Synthetic Indices

Ready to begin? Here’s what you need to know.

Finding the Right Trading Platform

The vast majority of trading activities for synthetic indices happen on the

MetaTrader 5 (MT5) platform. It’s a powerful and popular trading platform known for its advanced charting tools, extensive library of technical indicators, and support for automated trading.

Practical Tips for Success

To trade responsibly and effectively, follow these tips:

- Master Risk Management: This is non-negotiable. Never risk more than 1-2% of your trading capital on a single trade. Always use a stop-loss.

- Use Leverage Wisely: Leverage allows you to gain exposure to larger positions, but it amplifies losses just as much as profits. Start with low leverage until you are confident in your strategy.

- Start with a Demo Account: Before putting real money on the line, open a demo account. It’s the best way to familiarise yourself with the market dynamics of different synthetic indices without any financial risk.

Frequently Asked Questions (FAQ)

1. Can you really make money trading synthetic indices?

Yes, it is possible to profit from trading synthetic indices, just as with traditional markets. However, it also involves a high risk of loss. Profitability depends entirely on a trader's strategy, discipline, and risk management.

2. Which synthetic index is best for beginners?

Indices with lower volatility, such as some of the range-bound indices, are generally considered more suitable for beginners. High-volatility indices like the Volatility 75 Index 20 are popular but carry significantly higher risk and are better suited for experienced traders.

3. Are synthetic indices a scam?

No, synthetic indices offered by reputable, regulated brokers are not a scam. They are legitimate financial instruments whose price movements are generated by a transparent and audited algorithm. Always choose a well-regulated broker.

4. Why can you trade synthetic indices 24/7?

Because they are not tied to any real-world stock exchange or underlying assets, they do not have opening or closing hours. Their prices are generated continuously by a computer algorithm, allowing for 24/7/365 market availability.

5. What platform is used for trading synthetic indices?

The most widely used and recommended platform for trading these instruments is MetaTrader 5 (MT5).

So, Are Synthetic Indices Legit?

Yes, synthetic indices are legit financial trading instruments. They are created and offered by established forex brokers who are regulated by financial authorities. The mathematical formulas and algorithms used to generate them are audited to ensure fairness and transparency, meaning they cannot be manipulated.

The synthetic indices offer a unique way to participate in the global markets. They enable traders to focus purely on price action, test their strategies in consistent market conditions, and trade whenever they want. Whether you're a beginner or one of the more advanced traders, these markets provide a compelling alternative to foreign exchange and other real-world indices.

Top 5 Blogs

Balance Guard

Balance Guard