What is an Economic Calendar and How to Use It?

An economic calendar is one of the most popular fundamental analysis tools amongst traders, used for sourcing information on upcoming data and announcements that may impact the markets.

In this article, we will explore:

- What is an economic calendar?

- Key parts of an economic calendar

- Example of how to read an economic calendar

- Do you need an economic calendar?

- What news does an economic calendar provide?

- Most important economic calendar events

- How to use an economic calendar in trading or investing

- Frequently asked questions

What is an Economic Calendar?

An economic calendar is a schedule of key market-moving economic events. These events can have a significant impact on various financial markets, including stocks, forex, or commodities.

The economic calendar provides essential information on when these events will occur, what they entail, and how they might influence asset prices.

Key Parts of an Economic Calendar

An economic calendar will commonly provide the following information, although some calendars may have additional custom components.

- Date and time: The calendar lists events by date and time, enabling traders to plan their activities accordingly.

- Event: The title of the economic data, monetary policy decision or any other announcement to be made.

- Country or region: Events are categorized by the country or region where they occur, as different economies may have different market-moving events.

- Importance: The importance of different events can be classified as low, medium, or high, depending on how strongly those events may impact the markets.

- Previous and forecasted values: The calendar includes the previous data value (the last release of the indicator) and the expected value (what analysts and experts predict for the current release).

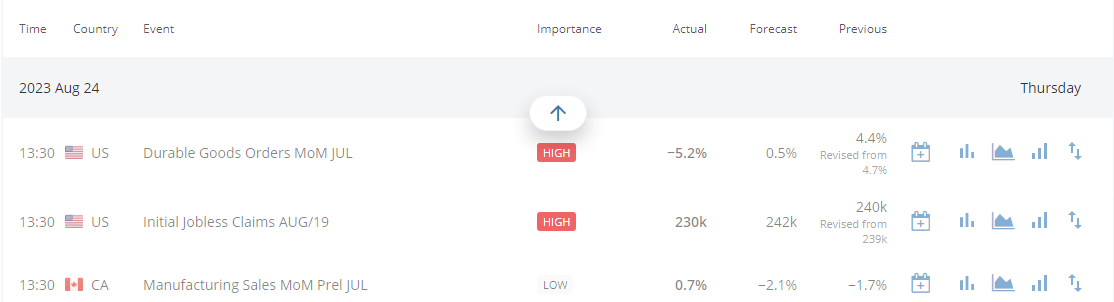

Example of How to Read an Economic Calendar

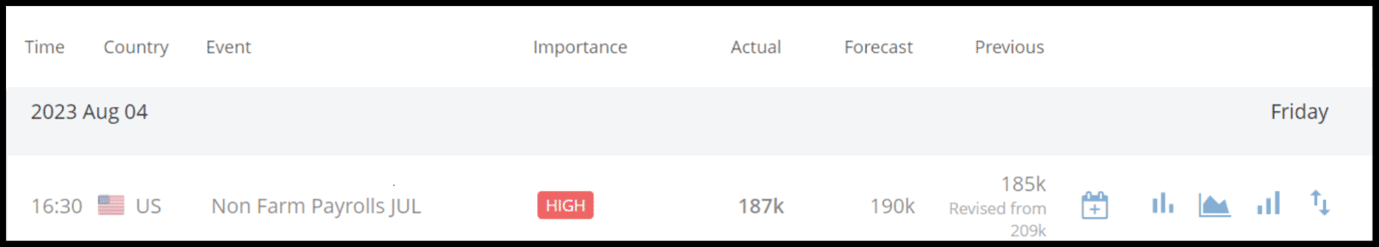

Consider a US economic calendar event for the non-farm payrolls report:

- Date and time: 04 August 2023 at 13:30 GMT

- Country: US

- Event: The US non-farm payrolls data for July

- Importance: High

- Actual: 187,000 jobs added

- Forecast: 190,000 jobs

- Previous: 185,000 jobs added

In this example, the actual value fell below the forecasted value, meaning that data was weaker than expected.

You can see more such economic events on the Hantec Markets economic calendar.

Do You Need an Economic Calendar?

An economic calendar provides essential information to traders and can be a helpful fundamental analysis tool for several reasons:

- Timely information: It helps you stay ahead of market-moving events, allowing you to prepare and adjust your trading decisions accordingly.

- Risk management: By knowing when critical events occur, you can reduce the risk of unexpected losses.

- Improved decision-making: It provides the data needed to make informed trading decisions.

- Strategic planning: You can align your trading strategy with anticipated market movements.

What News Does an Economic Calendar Provide?

An economic calendar lists out a range of different upcoming economic events, including:

- Economic indicators: Economic news and data such as GDP growth, inflation rates, and employment figures provide insights into the health of an economy.

- Central bank announcements: Interest rate decisions and policy statements from central banks that have a deep impact on forex and bond markets.

- Corporate earnings reports: Crucial for stock investors, these reports reveal a company's financial performance, affecting its stock price.

- Geopolitical events: News about elections, international conflicts, and trade deals, which can sway market sentiment.

- Forex events: FX traders can find information on events like non-farm payrolls, which influence forex markets.

Most Important Economic Calendar Events

While an economic calendar can list out many events, some have a bigger impact than others.

These events receive a high degree of attention across the world, and traders will look to either capture an opportunity amidst the volatility in the markets or hedge their risk.

Some of these more closely watched events are:

- Interest rate decisions: Announcements by central banks can significantly affect currency and bond markets.

- GDP releases: These provide an overview of a country's economic health.

- Non-farm payrolls: A critical indicator for the job market in the US, influencing various markets.

- Earnings reports: Particularly vital for stock investors, as they reveal a company's financial health.

- Inflation data: Such as the Consumer Price Index (CPI), which acts as a measure of inflation and can impact currency values and purchasing power.

How to Use an Economic Calendar in Trading or Investing

Now that we understand what an economic calendar is and how to read it let's delve into how traders can use this tool effectively:

1. Plan Ahead

Plan your trading activities around significant events to reduce the risk of unexpected market movements. Some FX traders, for instance, may avoid major currency pairs during central bank interest rate announcements, whereas some others may place a speculative bet on how prices might move.

2. Monitor Market Expectations

Pay close attention to the expected values in the calendar. These represent market consensus and analysts' predictions. If an economic indicator significantly deviates from the expected value, it can trigger rapid price movements, creating volatility in the markets.

3. Watch for the Actual Release

Once the economic data is released, monitor how the market reacts to it. If the actual value aligns with or surpasses expectations, it can lead to bullish (upward) market sentiment. Conversely, disappointing data can result in bearish (downward) sentiment.

4. Correlation with Your Trading Strategy

Incorporate the information from the economic calendar into your trading strategy. For example, swing traders might avoid opening new positions just before a major economic event to reduce the risk of sudden market shifts.

5. Diversify and Hedge

The economic calendar can also help with diversification and hedging strategies. If you trade a portfolio of stocks, consider how different economic events might impact each holding. Diversifying across assets with varying sensitivities to economic data can help mitigate risk.

6. Stay Informed and Adapt

The financial markets are dynamic, and unexpected events can occur at any time. It's essential to stay informed by regularly checking the economic calendar and being ready to adapt your trading strategy when necessary.

Frequently Asked Questions

Q: What news and information does an economic calendar provide?

A: An economic calendar offers a schedule of upcoming market-moving events, including economic indicators, central bank announcements, earnings reports, and geopolitical events.

Q: How to use the economic calendar for forex trading?

A: For forex trading, focus on events such as interest rate decisions, non-farm payrolls, and currency-specific data releases. Align your trading strategy with anticipated market movements following these events.

Q: Where can I find the economic calendar?

A: Access the Hantec Markets economic calendar for more information.

Q: Are economic calendars accurate in predicting market movements?

A: Economic calendars provide valuable information about upcoming events and market expectations. However, they do not guarantee the accuracy of market reactions.

Q: How often should I check the economic calendar?

A: The frequency of checking the economic calendar depends on your trading style. If you're a day trader or actively managing your portfolio, checking it daily or even several times a day may be necessary. Swing traders may find it sufficient to check it once a week, while long-term investors may focus on major events and earnings reports.

Top 5 Blogs

Balance Guard

Balance Guard