The Smart Money Concept (SMC): A Beginner’s Introduction to Institutional Trading

For years, the average retail trader has been taught a specific way to view the markets. You’ve likely seen the tutorials: wait for the RSI to become "oversold," look for a MACD crossover, or buy when the price touches a diagonal trendline. Yet, despite following these "golden rules," a staggering 90% of retail traders still lose money consistently.

Why does this happen? The answer lies in the fundamental misunderstanding of who moves the market and why. Retail indicators are designed to follow price action that has already occurred; they do not account for the massive injections of capital required to move a currency pair or stock.

The Smart Money Concept (SMC) offers a radical shift in perspective. Instead of relying on lagging indicators, SMC focuses on the footprints left by the world’s largest financial institutions. This guide will demystify the core pillars of institutional trading and show you how to view the charts through a lens of professional logic.

Key Takeaways

Retail Trading Pitfalls: Traditional indicators like RSI and MACD lag behind price action, trapping 90% of retail traders; institutions exploit stop-loss clusters at support/resistance for liquidity.

Smart Money Defined: Institutions (central banks, tier-1 banks, hedge funds) drive markets by engineering liquidity through traps, avoiding slippage on massive orders.

Core SMC Pillars:

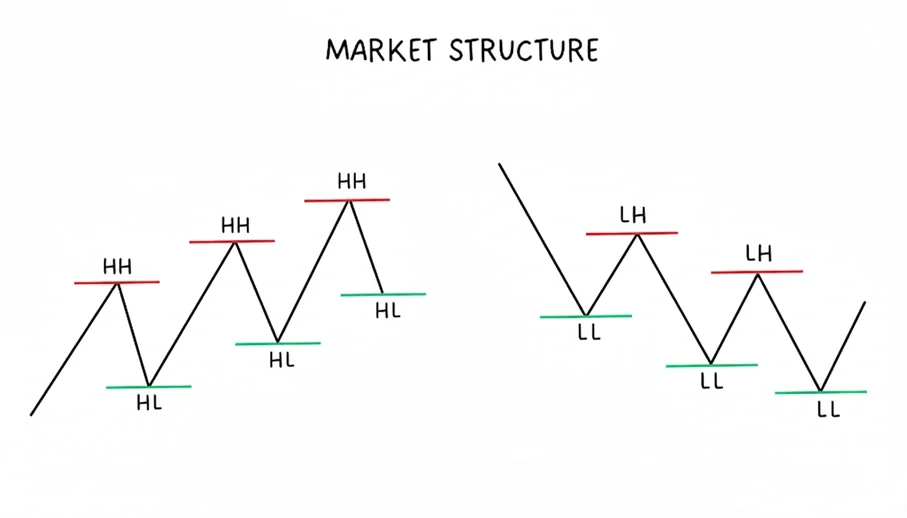

- Market Structure: BOS confirms trends; CHoCH signals reversals.

- Liquidity: EQH/EQL as stop-hunt targets.

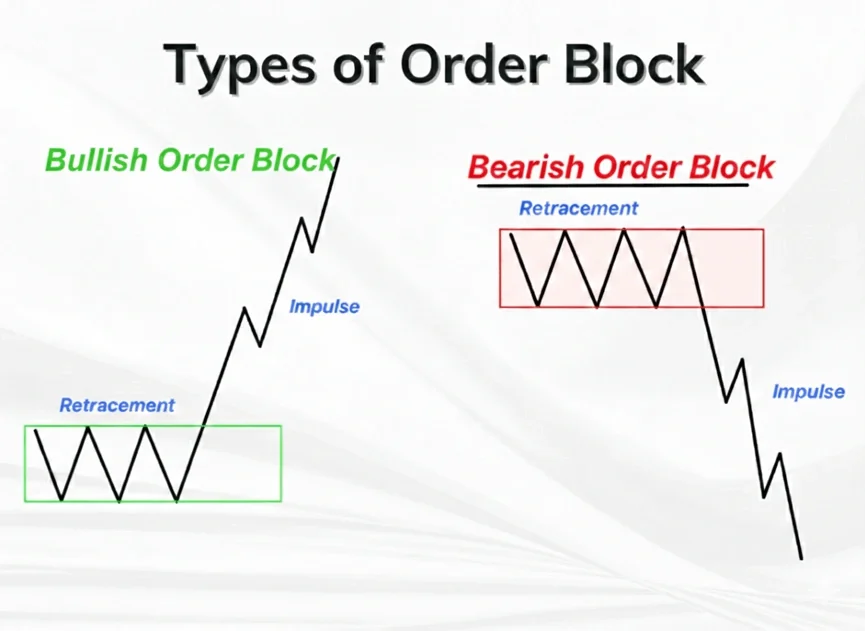

- Order Blocks: Zones of institutional orders causing sharp reactions.

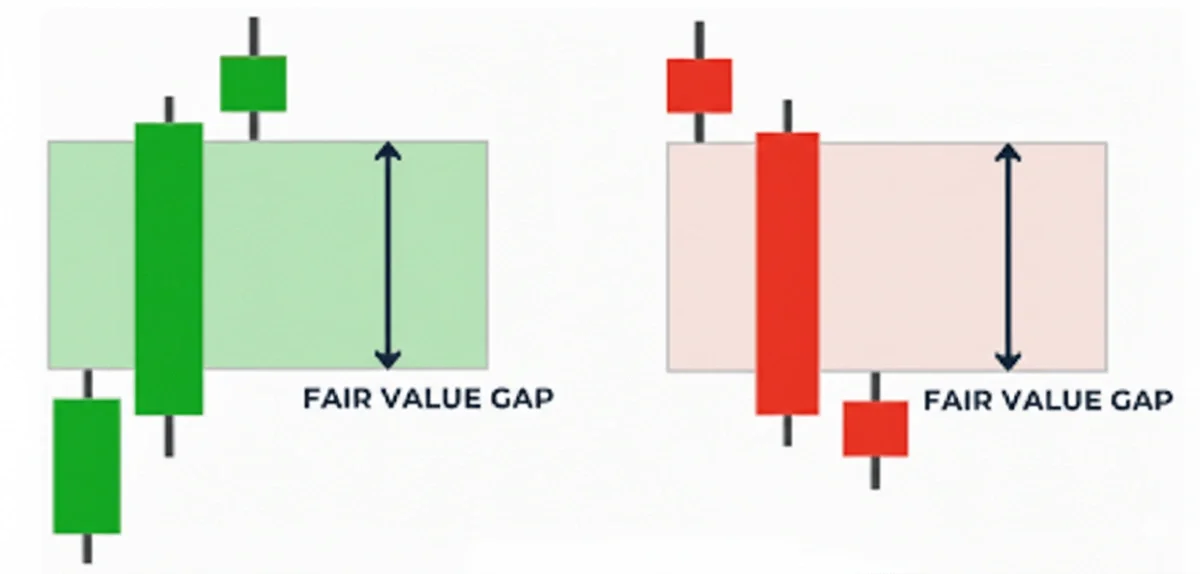

- Fair Value Gaps: Imbalances price seeks to fill.

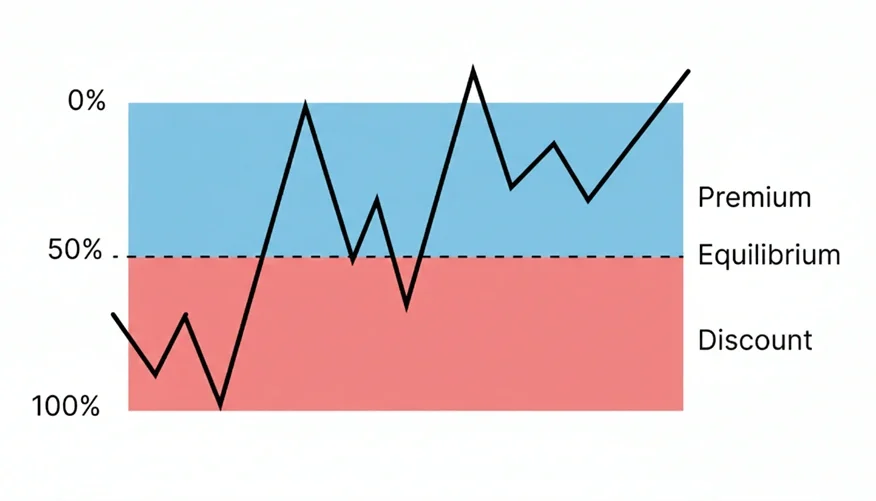

- Premium/Discount Zones: Buy below 50% Fib, sell above.

SMC Workflow: Determine HTF bias, mark structure/liquidity, wait for inducement/traps, confirm LTF CHoCH at OB/FVG, set tight stops targeting liquidity pools for high R:R.

Pros and Cons: Offers high R:R, market understanding, and psychological edge; but subjective, steep learning curve, risks over-analysis.

Key Advice: Practice on demo with backtesting and checklists; no holy grail—focus on discipline and risk management.

The Retail vs. Institutional Narrative: Why Most Traders Struggle

The traditional retail trading model is built on "lagging" information. Indicators like the Stochastic or RSI take past price data, smooth it out, and tell you what has already happened. By the time an indicator gives a "buy" signal, the big move is often already over, and the market is entering a retracement phase.

The Indicator Trap

Retail traders are often taught to use "support and resistance" lines. While these levels are real, they frequently act as liquidity pools—areas where millions of stop-loss orders are clustered. Big institutions are acutely aware of where these orders are. They often drive the price just past these levels to "hunt" those stops, liquidating retail positions to fill their own large orders before moving the market in the intended direction.

The SMC Paradigm Shift

SMC trading isn't just a strategy; it’s a framework. It operates on the premise that the market is not a random walk of "buying and selling pressure," but rather a highly sophisticated environment driven by Institutional Order Flow. By learning SMC, you stop trying to predict where the price should go based on a math formula on your screen and start following where the "Smart Money" is actually deploying its capital.

What Is Smart Money?

To trade like an institution, you must first understand the "whales" of the financial ocean. "Smart Money" refers to the massive entities that possess the capital requirements to actually shift the price of an asset.

Who Are the Institutions?

- Central Banks: The ultimate architects of currency value (e.g., The Fed, ECB).

- Tier-1 Banks: Institutions like JP Morgan, Goldman Sachs, and Citibank that handle the bulk of the world's daily foreign exchange volume.

- Hedge Funds & Institutional Investors: Multi-billion dollar funds that trade based on sophisticated algorithms and macroeconomic data.

- Liquidity Providers: Entities that ensure there is always a "counterparty" for every trade.

How and Why They Move Price

Unlike a retail trader who can enter and exit a position with a single click, Smart Money cannot move in and out of the market stealthily. If a bank wants to buy $500 million of EUR/USD, they cannot do it all at once without spiking the price and getting a "bad fill" (slippage).

Instead, they must engineer liquidity. They need to find enough sellers to match their massive buy orders. This often involves manipulating the market into "traps" that entice retail traders to sell (creating sell-side liquidity), providing the counterpart liquidity the institution needs to execute their massive buy orders at a favorable price.

Core Pillars of SMC (The Technicals)

SMC simplifies the "chaos" of the charts into a few logical building blocks. Mastering these is essential for understanding Forex market structure.

1. Market Structure: The Foundation

Market structure is the roadmap of the market. Price moves in a series of highs and lows.

- Break of Structure (BOS): This occurs when the price continues in its current trend. For example, in a bullish trend, when the price breaks above the previous "Higher High," it creates a BOS, confirming the trend's strength.

- Change of Character (CHoCH): This is the first signal of a potential trend reversal. It happens when the price breaks the specific structural low or high that was responsible for the last "push" in the trend.

2. Liquidity: The Fuel

Liquidity is essentially "money sitting on the charts." In SMC, we look for Equal Highs (EQH) or Equal Lows (EQL). Retail traders see these as "Strong Resistance" or "Strong Support" and place their stop losses just above or below them. Smart Money sees these as targets. They will "sweep" these levels to grab those stops before reversing the price.

3. Order Blocks (OB): Institutional Footprints

An Order Block (OB) is a specific candle or price zone where institutions previously placed massive orders that caused a significant move. These are effectively "supply and demand" zones on steroids. When the price returns to these zones, we often see a sharp reaction because institutions are "mitigating" (closing out or adding to) their remaining positions.

4. Fair Value Gaps (FVG)

An FVG occurs when there is an imbalance in the market - usually a massive, impulsive candle that leaves "holes" in the price action. Because the market seeks efficiency, it has a natural tendency to return to these gaps to "rebalance" the price before continuing its move.

5. Premium & Discount Zones

Smart Money logic dictates that you should always "buy low and sell high."

- Discount Zone: Using a Fibonacci tool from the start to the end of a price move, anything below the 50% equilibrium is the "Discount" area (ideal for buying).

- Premium Zone: Anything above the 50% equilibrium is the "Premium" area (ideal for selling).

The SMC Workflow: A Step-by-Step Look

Successful institutional trading requires a disciplined, top-down approach. You cannot look at a 1-minute chart in isolation; you must understand the "Big Picture."

- Identify Higher-Timeframe (HTF) Bias: Start with the Daily or 4-Hour chart. Is the overall market structure bullish or bearish? Determine if you are currently in a Premium or Discount zone.

- Mark Structure and Liquidity: Identify your most recent BOS and locate where retail "buy stops" and "sell stops" are resting. These are your targets or your "no-trade" zones.

- Wait for Inducement: Before entering, wait for the market to "trap" the retail traders. This usually looks like a fake breakout or a sweep of a liquidity level.

- Confirm Entry (The Lower-Timeframe Shift): Once price hits your HTF Order Block or FVG, drop down to a lower timeframe (like the 1m or 5m). Wait for a Change of Character (CHoCH). This confirms that the Smart Money has officially stepped back in.

- Define Risk and Targets: Set your stop loss just behind the Order Block and aim for the next major "liquidity pool" or structural high/low. This often results in high risk-to-reward ratios (e.g., risking $10 to make $50 or more).

Pros and Cons of Smart Money Concept

| Pros | Cons |

|---|---|

| High Risk-to-Reward: SMC allows for tight stop losses and massive targets, often yielding 1:5+ ratios. | Subjectivity: What looks like a "valid" Order Block to one trader might not be to another. |

| Market Logic: You understand why the price is moving, which drastically reduces trading anxiety. | Over-Analysis: Beginners often "see" order blocks on every candle, leading to analysis paralysis. |

| Psychological Edge: You stop feeling like the market is "out to get you" because you understand the traps. | Steep Learning Curve: It requires unlearning years of retail "indicators" and "trendline" habits. |

Conclusion & Summary

The Smart Money Concept (SMC) is more than just a set of rules; it is a lens that allows you to see the market's inner workings. By focusing on liquidity, order blocks, and market structure, you align yourself with the players who actually control price movement.

However, it is vital to remember that SMC is not a "holy grail" or a magic bot that guarantees success. It is a professional skill that requires months of screen time, backtesting, and, most importantly, strict risk management.

Final Tip: Do not rush into live markets. The complexity of institutional order flow takes time to digest. Start by identifying structural breaks on a demo account. Watch how the price reacts to Fair Value Gaps. Once you can "read" the footprints, the execution becomes the easy part.

Enhance Your Discipline: Download the "SMC Trade Checklist"

Consistency is the difference between a gambler and a professional trader. To help you stay on track and avoid "revenge trading" or forced entries, we’ve developed a Downloadable SMC Trade Checklist.

What’s inside the checklist?

- Daily Bias Confirmation: Ensuring you are trading with the institutional flow.

- Liquidity Audit: Have you identified the "retail traps" before entering?

- Refinement Rules: How to pick the best lower-timeframe entry.

- Risk Management Protocol: A step-by-step guide to calculating your position size.

Top 5 Blogs

Balance Guard

Balance Guard