Inflation

How Inflation affects financial markets

The level of inflation is one of the most important factors determining a currency’s strength. This is because inflation has a direct impact on central bank monetary policy.

Increasing inflation will push the central bank to consider tightening monetary policy by increasing interest rates. This is because:

- Too little inflation runs the risk of an economy falling into deflation.

- Too much inflation erodes the real value of money in the economy.

A central bank will aim to use monetary policy to regulate inflation at low and steady levels, often as its primary mandate.

INFOBOX: Inflation, Disinflation and Deflation

- INFLATION – is a general increase in the price level from one period to the next, usually, measure on an annual basis.

- DISINFLATION – This is where there is inflation in the economy, but the level of inflation is falling. The general level of prices is still rising from one period to the next but at a lower rate. For example, an economy that has a trend of inflation that has previously been at 2.0% then falls to 1.5% and then subsequently to 1.0% is experiencing a period of falling inflation, or disinflation.

- DEFLATION – This is where inflation has gone negative. The general level of prices has fallen from one period to the next. This is considered to be bad for the economy. The concern is that consumers accept that deflation is taking hold, which drives spending lower in the belief that prices of goods will be lower in the future.

Why is inflation so important?

Central banks look at inflation and use it as a primary gauge as to how to implement monetary policy. A central bank that sees inflation rising will be mindful that it may need to raise interest rates to keep control on prices. An increase in interest rates will make it more expensive to borrow and will subsequently choke off demand in the economy. The decrease in demand will then begin to put downward pressure on general price levels and moderate inflation again.

Inflation can, therefore, have a direct impact on monetary policy. For example, the US Federal Reserve (the Fed) has a “dual mandate” enacted into law by the Federal Reserve Act of 1977.

One part of the dual mandate is to promote price stability, and the other part is concerned with keeping unemployment low. The Fed has subsequently set a 2% inflation target that it is mandated to work towards. The Bank of England also has a 2% target for the Consumer Prices Index, while the European Central Bank’s mandate is for an inflation rate “below but close to 2%”.

The various inflation announcements

There are several economic data releases through the month, which can provide you with a steer on inflation. Any increase in these indicators tends to be positive for the domestic currency and negative for bond prices. The key ones to watch for are:

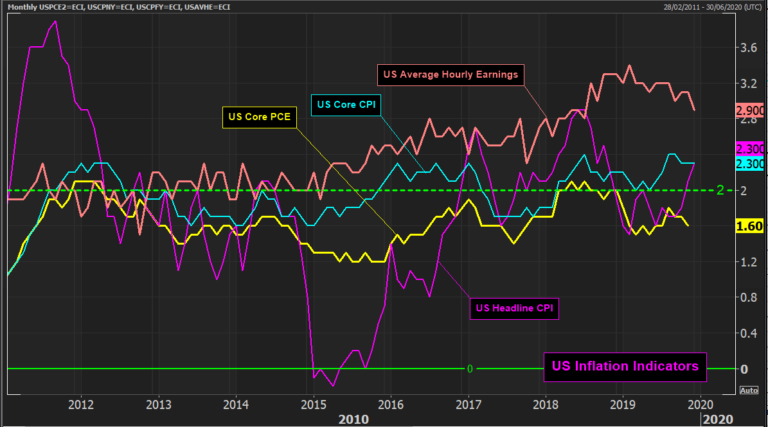

Consumer Prices Index (CPI)

This indicator is the accepted international gauge of inflation and will have a big impact on the domestic currency and bonds. The headline CPI includes volatile food and energy prices, so the core CPI is often a better gauge of inflation as it strips out and adjusts for volatile factors. If the headline CPI remains flat while the core CPI is increasing, this will impact the forex and bond markets. You should watch for both numbers and look out for the year-on-year data predominantly.

Personal Consumption Expenditure (PCE)

PCE is a US indicator and the Federal Reserve’s preferred measure of inflation. This is because consumers account for around 70% of final spending in the US.

Average earnings growth

An indicator that shows how wages are growing. On the principle that wage growth is a key factor in determining living standards, average earnings growth is a key component in the state of the economy. If (nominal) earnings growth is consistently higher than CPI, then real wages will be rising, and therefore people’s living standards will be on aggregate rising.

However, strong wage growth is also a likely indicator of future inflation, as people have more money to spend. In the US wage growth is measured in the Employment Situation report (i.e. the Non-farm Payrolls report) as “Average Hourly Earnings”; while in the UK it is announced with the employment data and is measured as “Average Weekly Earnings”.

Producer Prices Index (PPI)

Also known as “factory-gate inflation” measures the change in selling prices received by domestic producers of goods and services. The theory suggests that retailers will push increases in their costs on to the consumer, and is therefore used to predict CPI.

Employment Cost Index (ECI)

A quarterly data release provides a broad measure of labour costs for employers in the US. Wages and salaries account for around 70% of the total employment cost. The ECI is also a measure of capacity in the labour market and is feedthrough into earnings growth and, subsequently, inflation.

The impact of inflation on financial markets

Bond markets are very sensitive to changes in inflation, thanks to the potential impact they have on monetary policy and expectations about future monetary policy. If bond markets expect inflation to rise (and subsequently also expectations of interest rates to rise), bonds will come under selling pressure. This pushes the price of bonds lower, meaning the yield will rise due to their fixed-income properties.

Forex markets will also directly move on changes to inflation expectations due to its close links to monetary policy. Rising inflation increases the probability that the central bank will raise interest rates. This, in turn, increases the demand for the domestic currency due to changing expectations of interest rate differentials – driving “hot money” flows. Therefore, the price of the domestic currency will improve relative to the currencies of other countries.

Performance of equity markets due to changes in inflation is uncertain. There are numerous factors to weigh up, depending upon the size of the change, the direction and the level of inflation. All things remaining equal, rising inflation means rising interest rates. However, that also increases interest expenses for corporates who prefer a lower interest rate environment where it is cheaper to borrow. Subsequently higher inflation may drive equity prices lower.

As is ever the case in financial markets, however, nothing is entirely black and white.