What are Asset Classes?

Understand the various types of asset classes, what they are and how can you utilise them.

Written by Aaron Akwu, Head of Education Hantec Markets

What is an Asset Class?

Asset class refers to a categorization or classification of financial instruments or investments based on their characteristics, risk profile, and potential returns. It plays a crucial role in portfolio construction and diversification strategies for investors. By understanding the concept of asset classes, individuals can make informed decisions regarding their investment strategies and asset allocation.

Understanding Asset Classes: A History Perspective

When it comes to navigating the world of investments, it's crucial to have a solid understanding of asset classes. Over the years, the concept of asset classes has evolved, enabling investors to diversify their portfolios and manage risk effectively. By comprehending the characteristics and historical performance of different asset classes, individuals can make informed decisions and potentially enhance their investment strategies.

The notion of asset classes dates back to the early days of financial markets. As economies developed and investment opportunities expanded, market participants recognised the need to categorise investments based on their fundamental characteristics. This categorisation facilitated the comparison of various investment options and helped investors gauge the potential risks and rewards associated with each class.

Today, asset classes encompass a wide range of investment vehicles that offer distinct features and potential returns. They are typically grouped based on similar attributes such as risk, return potential, and correlation to broader market trends. These classifications enable investors to diversify their portfolios by allocating their funds across different asset classes, spreading risk and potentially enhancing returns.

One of the major asset classes is fixed income. Fixed-income investments, also known as bonds, provide investors with a steady stream of income through regular interest payments. These investments are generally considered less volatile than other asset classes and are often sought after by individuals seeking stable returns and capital preservation.

Asset allocation, which refers to the strategic distribution of investments across different asset classes, plays a vital role in portfolio construction. By diversifying across multiple asset classes, investors can reduce the impact of any one investment's performance on their overall portfolio. This approach helps manage risk and potentially enhances the chances of achieving long-term financial goals.

While fixed income is just one example, there are several other asset classes available to investors. These include equities (stocks), real estate, commodities, and alternative investments. Alternative investments, such as hedge funds, private equity, crypto, and venture capital, offer unique opportunities outside of traditional asset classes. They often exhibit different risk-return profiles and can provide diversification benefits when combined with other asset classes.

Understanding the historical performance and characteristics of different asset classes is essential for investors looking to construct a well-balanced portfolio. However, it's important to note that the performance of asset classes can vary significantly over time, influenced by various economic, geopolitical, and market factors.

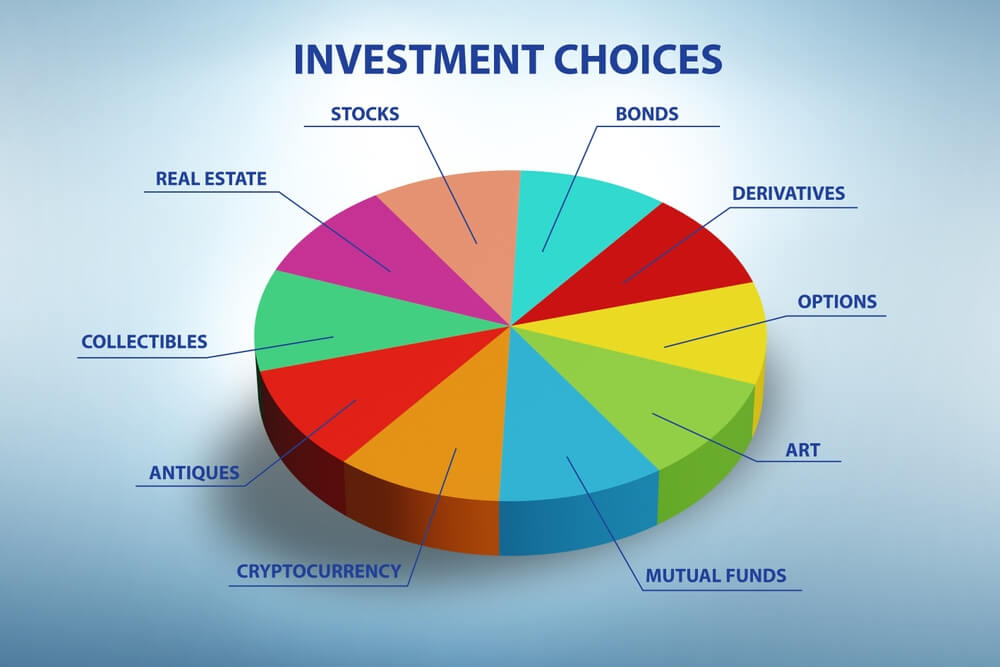

Types of Asset Classes

When it comes to investing, there are various types of asset classes available to individuals seeking to diversify their portfolios. These asset classes represent different categories of investment assets, each with its own unique characteristics and potential for returns. In this segment, we will explore some of the main asset classes.

- Equities (Stocks): Equities are a popular asset class that represents ownership in a company. Investors purchase shares of a company’s stock, which entitle them to a proportional ownership stake. Stocks offer the potential for capital appreciation as well as dividends. For example, technology giants like Apple Inc. (AAPL) and Microsoft Corporation (MSFT) are prominent equity investments.

- Fixed Income Securities: Fixed income securities, which can include government or corporate bonds, are debt instruments that pay a fixed amount of interest over a specific period of time. These investments provide regular income to investors. Examples of fixed income securities include U.S. Treasury bonds and corporate bonds issued by companies like Johnson & Johnson (JNJ) or General Electric (GE).

- Cash Equivalents: Cash equivalents are highly liquid, short-term investments that can be easily converted to cash. They offer stability and provide a safe harbor for investors. Examples of cash equivalents include Treasury bills (T-bills), certificates of deposit (CDs), and money market funds.

Alternative Asset classes

When it comes to investing, many individuals are familiar with traditional asset classes such as stocks, bonds, and cash. However, there exists a range of alternative asset classes that can offer unique opportunities for diversification and potentially higher returns. Let's look at several alternative asset classes:

One popular alternative asset class is precious metals, such as gold, silver, platinum, and palladium. These commodities have been valued throughout history for their intrinsic qualities and can serve as a hedge against inflation and economic uncertainties.

- Real Estate:

Investment property, including residential and commercial real estate, represents another alternative asset class. Real estate investments can generate rental income and potential appreciation, offering diversification outside the traditional financial markets.

- Private Equity:

Private equity involves investing in privately held companies that are not publicly traded on the stock market. This asset class offers the opportunity to participate in the growth of promising startups, mature private companies, or even buyouts and restructuring initiatives.

- Hedge Funds:

Hedge funds are investment vehicles managed by professional fund managers who aim to generate returns regardless of the overall market conditions. These funds often employ various strategies to mitigate risk and seek absolute returns.

- Venture Capital:

Venture capital is an alternative asset class that focuses on early-stage companies with high growth potential. Investors provide capital to startups in exchange for an equity stake, supporting innovative ideas and potentially reaping substantial returns if the company succeeds.

- Cryptocurrencies:

The emergence of cryptocurrencies, such as Bitcoin and Ethereum, has created a new and exciting alternative asset class. These digital currencies operate on blockchain technology and offer investors the potential for significant returns, albeit with higher volatility and risk.

Commodities encompass a wide range of tangible goods, including agricultural products (e.g., wheat, corn), energy resources (e.g., oil, natural gas), and industrial metals (e.g., copper, aluminium). Investing in commodities can provide a hedge against inflation and diversify a portfolio.

- Collectables:

Investing in collectables, such as rare coins, stamps, art, or vintage cars, represents a unique alternative asset class. Collectibles can appreciate in value over time due to their scarcity, historical significance, and aesthetic appeal.

By exploring these alternative asset classes, investors can potentially diversify their portfolios beyond the traditional asset class categories. However, it's important to note that alternative investments often carry their own risks and may require specialized knowledge and due diligence.

Before considering any alternative asset class, it is crucial to consult with professionals, such as financial advisors, who can provide guidance tailored to your specific investment goals and risk tolerance. They can help evaluate the potential benefits and risks associated with each alternative asset, ensuring that your investment decisions align with your overall financial strategy.

Asset Class and Investing Strategy

Developing an effective investing strategy involves understanding one's financial goals, risk tolerance, and time horizon. Here are some common strategies:

- Buy and Hold: This strategy involves buying investments with a long-term view, believing in their potential growth over time. Investors using this approach typically focus on fundamentally strong assets and stay invested for years, if not decades.

- Value Investing: Value investors seek undervalued assets that they believe the market has overlooked. They analyze factors like price-to-earnings ratios, book values, and other indicators to identify potential bargains. The goal is to buy assets at a discount and wait for their true value to be recognized.

- Growth Investing: Growth investors focus on companies or sectors with high growth potential. They prioritize investments that are expected to experience above-average growth rates, even if the current valuation may be relatively high. This strategy aims to capture significant capital appreciation over time.

- Income Investing: Income-oriented investors prioritize generating a steady stream of income from their investments. They often prefer assets like dividend-paying stocks, bonds, or real estate investment trusts (REITs) that provide regular cash flow.

- Dollar-Cost Averaging: This strategy involves regularly investing a fixed amount of money at predetermined intervals, regardless of market conditions. By investing consistently over time, investors can potentially reduce the impact of market volatility and take advantage of buying opportunities during market downturns.

Remember, investing involves risks, and it's crucial to conduct thorough research, diversify your portfolio, and consider seeking professional advice before making any investment decisions.

Why are asset classes useful?

Let's look into why asset classes are essential:

- Diversification:

One of the primary benefits of asset classes is diversification. By spreading investments across multiple asset classes, investors can reduce the risk associated with any single investment. Diversification is key to mitigating volatility and minimizing the impact of market fluctuations on overall portfolio performance.

For instance, let's consider an investor who allocates their entire portfolio to a single stock. If that stock experiences a significant decline, the investor's entire investment is at risk. However, by diversifying across multiple asset classes, such as stocks, bonds, and real estate, the investor can offset potential losses in one asset class with gains in another. This approach helps protect the portfolio from substantial downturns.

- Risk-Return Tradeoff:

Different asset classes offer varying levels of risk and potential returns. The risk-return tradeoff is a fundamental concept in finance, where higher-risk investments generally have the potential for higher returns.

Let's illustrate this with an example. Suppose an investor decides to allocate a portion of their portfolio to stocks, which historically have offered higher average annual returns compared to other asset classes. Over a 10-year period, the stock portion of their portfolio generates an average annual return of 8%. In contrast, the bond portion, which is generally considered less risky, provides an average annual return of 4%.

By diversifying between stocks and bonds, the investor achieves an overall portfolio return that combines the returns of both asset classes. In this case, the weighted average return of the portfolio would be higher than if the investor had solely invested in bonds. Thus, asset classes allow investors to balance risk and return according to their risk tolerance and investment goals.

- Liquidity and Cash Flow:

Asset classes differ in their liquidity, which refers to how quickly an investment can be converted into cash without incurring significant transaction costs or price discounts. Liquidity is crucial for meeting short-term cash flow needs or taking advantage of investment opportunities.

For example, cash equivalents, such as money market funds or short-term Treasury bills, provide high liquidity, allowing investors to access their funds quickly. In contrast, real estate investments typically have lower liquidity, as it may take time to sell a property and convert it into cash.

By including different asset classes in a portfolio, investors can maintain a balance between liquid assets and those with longer-term growth potential. This approach ensures that there is sufficient liquidity to cover immediate financial requirements while capitalizing on the long-term growth potential of less liquid investments.

Balance Guard

Balance Guard