Find out 6 trading strategies every trader should know: Swing Trading, Position Trading, Day Trading, Price Action Trading, Algorithmic Trading, News Trading,etc.

Please be advised that our Client Portal is scheduled for essential maintenance this weekend from market close on Friday 5th April, 2024, and should be back up and running before markets open on Sunday 7th April, 2024.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

A trading journal is a personalised record-keeping tool that allows traders to document and analyse their trading activities systematically.

Written by Aaron Akwu, Head of Education Hantec Markets

In the constantly changing realm of forex trading, where every decision can make or break your success, a trading journal stands out as a valuable companion for both newbies and seasoned experts. A trading journal is a personalised record-keeping tool allowing traders to document and analyse their trading activities systematically.

A trading journal is more than just a notebook filled with numbers and charts. It is a comprehensive diary for traders to log their trades, strategies, and emotions associated with each trading decision. The primary purpose is to provide a structured platform for self-reflection and improvement.

At the heart of your trading journal lies the detailed account of each trade. Documenting the specifics of your trades allows you to revisit them later for analysis and learning. Include information such as the currency pair traded, the direction of the trade (long or short), and any other relevant market conditions.

Time is of the essence in the forex market, and recording the date and time of each trade is crucial for assessing market volatility and identifying optimal trading windows. This information also aids in recognising patterns in your trading behaviour during specific times of the day.

Specify the financial instrument or currency pair involved in the trade. Documenting traded instruments helps you identify which assets are more profitable and allows for a more targeted approach in future trading decisions.

Pinpointing your trades’ exact entry and exit points is fundamental for assessing the effectiveness of your trading strategy. Understanding why you entered or exited at a particular price level provides valuable insights into your decision-making process.

The size of your position is a critical factor in managing risk and determining the potential profitability of a trade. Track the position size in your trading journal to analyse how it aligns with your overall risk tolerance and trading strategy.

Managing risk is paramount in forex trading. Document the risk management strategies employed for each trade, including the placement of stop-loss and take-profit orders. Risk management allows you to evaluate the efficacy of your risk management techniques over time.

Forex trading is a dynamic field that requires traders to make split-second decisions. Your ability to make informed and effective decisions directly impacts your success. By diligently recording every trade in your journal, you create a valuable resource for reviewing your decision-making process.

Regularly analysing your trades lets you identify the strategies that work well and those that fall short. This reflective process allows you to fine-tune your decision-making approach, learning from successful and unsuccessful trades. Over time, this leads to a more refined and strategic trading mindset, ultimately boosting your overall performance.

Success in Forex trading often hinges on your ability to recognise patterns and trends in the market. A trading journal serves as a treasure trove of data, enabling you to spot recurring patterns in your trades. You can uncover valuable insights into the trends influencing your success by categorising and analysing your entries, exits, and overall market conditions.

This pattern recognition helps refine your trading strategies and enables you to anticipate market movements more effectively. Armed with this knowledge, you can adapt your approach to capitalise on emerging trends, giving you a competitive edge in the ever-changing Forex landscape.

Emotions play a significant role in trading. Fear, greed, and anxiety can cloud your judgment and lead to impulsive decisions that may not align with your trading strategy. A trading journal acts as a mirror, reflecting your emotional state during each trade.

By documenting your emotions, you become more aware of patterns in your psychological responses to various market conditions. This heightened awareness is the first step toward gaining control over your feelings. As you recognise and understand your emotional triggers, you can implement strategies to manage and mitigate their impact on your decision-making process, leading to more disciplined and objective trading.

Accountability is a cornerstone of success, and Forex trading is no exception. A trading journal holds you accountable for your actions by clearly recording your trades and decisions. It serves as a performance benchmark, allowing you to assess whether you adhere to your trading plan and strategy.

Reviewing your journal entries helps you stay focused on your long-term goals and avoid deviating from your established trading principles. The sense of accountability instilled by a trading journal encourages discipline and consistency, essential traits for sustained success in the forex market.

The first crucial step in creating your trading journal is deciding on the format that suits your preferences and trading style. Two main options exist: digital and physical.

Many traders opt for online platforms or specialised trading journal software, embracing the digital age. These tools offer convenience, accessibility, and advanced features such as automatic data analysis. One popular example is Evernote, which allows you to create digital notebooks for each trade, attach charts, and even add voice memos to capture your thoughts at the moment.

Example of a digital trading journal using Evernote.

The digital format is particularly advantageous for traders who prefer real-time access to their data, quick updates, and the ability to share insights with others easily.

A physical trading journal might be ideal for traders who appreciate the tangible connection with their records. A simple notebook can be a canvas for documenting trades, market observations, and personal reflections. Many traders find that physically writing down details enhances memory and focus.

Example of a physical trading journal using a notebook.

While less tech-savvy, physical journals provide a tactile experience that some find enhances the overall trading journey.

Regardless of your chosen format, the next step is customising your trading journal to capture the most relevant information. Your journal should be a reflection of your unique trading strategy and goals. Consider including the following key fields:

Integrate performance metrics to elevate your trading journal into a powerful analytical tool. These metrics will allow you to evaluate your success and identify areas for improvement.

– Calculate the percentage of profitable trades versus losing trades.

– Measure the profitability of your trades in percentage terms.

– Assess the peak-to-trough decline in your trading capital during losing streaks.

– Determine how often you are executing trades and if any patterns emerge.

– Set goals for each trade and assess whether you achieved them.

Let’s look into some common mistakes traders make in maintaining their trading journals and explore ways to overcome them.

A reliable trading journal’s foundation lies in its entries’ accuracy and completeness. Yet many traders neglect this fundamental aspect. Only complete or accurate record-keeping is necessary for the journal’s purpose and helps a trader’s ability to make informed decisions.

Solution:

Consistency is the key to success in forex trading, and this principle extends to maintaining a trading journal. Some traders sporadically update their journals, undermining the document’s effectiveness as a learning tool.

Solution:

Set a routine for updating your trading journal. Whether it’s at the end of each trading day or week, consistency will help you identify patterns, track progress, and adjust your strategy on time.

A trading journal is more than a tool for keeping records; it’s a place where valuable insights are waiting to be uncovered. Sadly, some traders make the mistake of simply recording their trades without analysing and learning from them.

Solution:

Consistency is vital when it comes to analysing your trading journal. Like the forex market, your performance is subject to fluctuations, and staying on top of your game is crucial. Set aside dedicated time at regular intervals, whether weekly, bi-weekly, or monthly, to thoroughly review your journal entries.

During these reviews, pay attention to patterns and trends in your trading behaviour. Identify recurring mistakes, emotional triggers, and successful strategies. Maintaining a regular review cadence can connect your actions and their consequences, fostering a deeper understanding of your trading style.

One of the primary purposes of keeping a trading journal is to learn from your experiences and make informed adjustments to your strategies. As you pore over your entries, ask yourself critical questions:

By answering these questions honestly, you can pinpoint areas for improvement and refine your trading strategies accordingly. You may notice a tendency to overtrade during certain market conditions or a reluctance to cut losses promptly. Armed with these insights, you can adjust your approach, gradually eliminating detrimental habits and reinforcing those contributing to success.

A trading journal isn’t just a record of individual trades; it’s a roadmap for your long-term success. As you analyse your performance, use the information to set realistic and measurable long-term goals. These goals include improving your win rate, reducing drawdowns, or enhancing your risk management practices.

By setting long-term goals, you create a framework for continuous improvement. Break down these overarching objectives into smaller, achievable milestones. Celebrate your successes, learn from setbacks, and refine your goals as you evolve as a trader.

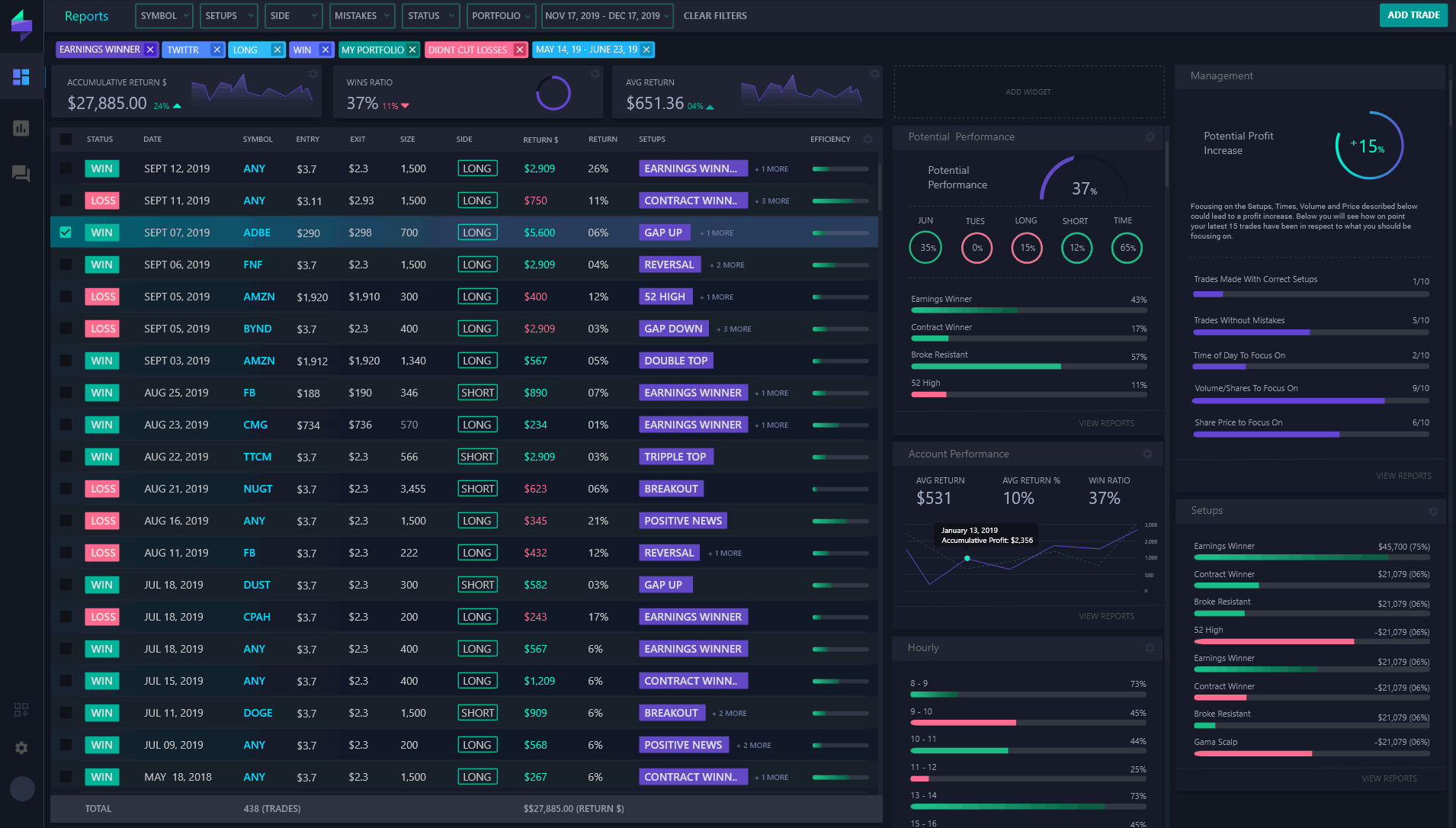

In modern times, traders have access to numerous digital tools and apps that can assist them in keeping track of their trades and refining their strategies through a trading journal. This post reviews some of the most popular and best trading journal platforms and apps in 2024. We’ll compare their features, functionalities, pros, and cons so that traders can choose one.

TraderSync is an online trading journal app that offers in-depth performance reports, AI-powered feedback, and a simulator. With this app, traders can import trades from various brokers and platforms, track their statistics, and generate reports. Other features include trade tagging, trade review, trade simulator, and goal setting.

Some of the pros of TraderSync are:

However, there are also some cons to using TraderSync:

Tradervue is another online trading journal app that lets traders import their trades, analyse their data, and share their trades with others. It has advanced features like trade execution analysis, risk management, and custom reports.

Some of the pros of Tradervue are:

However, there are some cons to using Tradervue, including:

Trademetria is a simple and easy-to-use online trading journal app that allows traders to import their trades, track their statistics, and generate reports. It also has features such as trade tagging, trade reviews, and trade alerts.

Some of the pros of Trademetria are:

However, there are some cons to using Trademetria:

In conclusion, a trading journal is more than a record-keeping tool; it’s a compass guiding you through the intricate world of forex trading. Whether you’re a novice seeking stability or an expert aiming for perfection, a well-maintained trading journal is the cornerstone of your success. Embrace, analyse, and let it drive your journey to becoming a consistently profitable forex trader.

Find out 6 trading strategies every trader should know: Swing Trading, Position Trading, Day Trading, Price Action Trading, Algorithmic Trading, News Trading,etc.

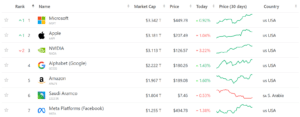

In this post, we explore the largest companies in the world that currently boast a market capitalization of over $1 trillion.

Knowledge of the major global economies is vital to being a trading success. This article will look at the world’s 10 largest economies by GDP.

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Please click here to view our Risk Disclosure.

Hantec Markets use cookies to enhance your experience on our website. By staying on our website you agree to our use of cookies. You can access our Cookie Policy here

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Please click here to view our Risk Disclosure.

Hantec Markets use cookies to enhance your experience on our website. By staying on our website you agree to our use of cookies. You can access our Cookie Policy here

Hantec Markets is a trading name of Hantec Group.

This website is owned and operated by Hantec Markets Holdings Limited. Hantec Markets Holdings Limited is the holding company of Hantec Markets Limited and Hantec Markets Ltd.

Hantec Markets Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the UK (Register no: FRN 502635).

Hantec Markets Ltd. is authorised and regulated as an Investment Dealer by The Financial Services Commission of Mauritius (License no: C114013940).

The services of Hantec Markets and information on this website are not aimed at residents of certain jurisdictions, and are not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use may be contrary to any of the laws or regulations of that jurisdiction. The products and services described herein may not be available in all countries and jurisdictions. Those who access this site do so on their own initiative, and are therefore responsible for compliance with applicable local laws and regulations. The release does not constitute any invitation or recruitment of business.

Hantec Markets does not offer its services to residents of certain jurisdictions including USA, Iran, Myanmar and North Korea.

We are transferring you to our affiliated company Hantec Trader.

Please note: Hantec Trader does not accept customers from the USA or other restricted countries.