Find out 8 trading strategies every trader should know: Swing Trading, Position Trading, Day Trading, Price Action Trading, Algorithmic Trading, News Trading,etc.

Please be advised that our Client Portal is scheduled for essential maintenance this weekend from market close on Friday 5th April, 2024, and should be back up and running before markets open on Sunday 7th April, 2024.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The risk-reward ratio is a metric used to evaluate the potential profitability of a trade by comparing the amount of risk taken to the potential reward that can be gained. It is calculated by dividing the potential profit of a trade (reward) by the amount of potential loss (risk).

In the forex market, managing risk is critical, and the risk-to-reward ratio (RRR) is an essential concept to understand. The RRR is the ratio of the potential risk to potential reward in a trade, representing the amount of money you could lose compared to the amount you could gain. It’s a vital measure of the risk and reward balance of trade, and as such, it’s an essential tool for risk management.

When developing a trading strategy, it’s essential to consider the potential risk and profit targets, as well as your risk appetite. By setting a profit target and using the RRR, you can identify trades with a better risk ratio, which means the potential reward is higher than the potential risk. A higher RRR means a better trading opportunity, as it means you can potentially make more money for every dollar you risk. Therefore, the RRR is a crucial factor in determining the profitability of a trading strategy, and it helps you identify the balance between risk and reward to achieve long-term success in the forex market.

Lot-size: Lot size in forex refers to the number of currency units you are buying or selling in a particular trade. It is one of the critical factors that determines the risk-reward ratio (RRR) of a trade. RRR is the ratio of the potential profit of a trade to the amount of risk you are willing to take.

The lot size you choose for a trade can significantly affect your RRR. A smaller lot size means you are risking less money on the trade, which reduces your potential profit. On the other hand, a larger lot size means you are risking more money, which can increase your potential profit.

For example, if you are trading the EUR/USD pair and the current price is 1.2000, and you want to buy, you could choose to buy 1 lot, which is equivalent to 100,000 EUR. If the price goes up by 10 pips to 1.2010, you will have made a profit of $100 ($10 per pip x 1 lot) and if it goes down by 10 pips, you will have a loss of $100 as well. However, if you had chosen to buy 0.1 lots, your profit/loss would only be $10 for the same price movement.

It is crucial to determine the appropriate lot size based on your risk tolerance and trading strategy to achieve a favourable RRR.

Margin: Margin is the amount of money required by a forex trader to maintain a position in the market. It is a deposit that a trader needs to make to open and maintain a position in the forex market. Margin requirements vary depending on the currency pair being traded, the size of the position, and the broker’s policy.

Margin and RRR are related because the margin requirement affects the RRR. A larger margin requirement means that a trader needs to put up more money to maintain a position. This, in turn, affects the RRR because the potential profit of a trade will need to be larger to cover the increased margin requirement.

For example, if a trader wants to trade a currency pair with a margin requirement of 2%, they would need to put up $2,000 to maintain a position worth $100,000. If the RRR is 2:1, then the potential profit of the trade would need to be $4,000 to cover the margin requirement and achieve the desired RRR.

Leverage: In forex trading, leverage refers to the ability to control a large position with a relatively small amount of capital. It is provided by the forex broker and allows traders to magnify their potential profits (and losses) by effectively borrowing money from the broker to open a larger position than they could with their own funds.

When using leverage, traders need to consider the impact of their chosen RRR on their margin requirements. For example, if a trader wants to open a position with a RRR of 1:2 and the leverage provided by their broker is 1:100, they would need to put up a margin of 1% of the total position size (i.e., 1/100th of the position size).

However, if the trader wanted to use a RRR of 1:5 for the same trade, they would need to put up a larger margin of 2% of the total position size. This is because the potential loss is now five times larger than the initial margin required for the 1:2 RRR trade.

Spread: In forex trading, “spread” refers to the difference between the bid price (the price at which a currency can be sold) and the ask price (the price at which a currency can be bought).

When the spread is large, it means that the difference between the bid and ask price is significant, and this can have an impact on the RRR. For instance, if a trader enters a trade with a tight stop loss, a larger spread will mean that the trade will have to move further into profit before the profit target is reached. This means that the potential profit will be reduced, and hence the RRR will be affected.

On the other hand, if the spread is tight, the RRR will be improved since the trader will require less movement in the price to reach their profit target. Therefore, it is important for traders to consider the spread when planning their trades to ensure they are getting the best RRR possible.

It is calculated by comparing the potential profit (reward) of a trade to the potential loss (risk) of the same trade. The formula for the risk-reward ratio is:

Risk Reward Ratio = (Take Profit – Entry Price) / (Entry Price – Stop Loss)

The risk-reward ratio can be expressed as a ratio, a percentage, or a decimal. If the ratio is greater than 1:1, it means that the potential reward is greater than the potential risk, which is considered a favourable ratio for the trade. Conversely, if the ratio is less than 1:1, it means that the potential risk is greater than the potential reward, which may indicate that the trade is not worth taking.

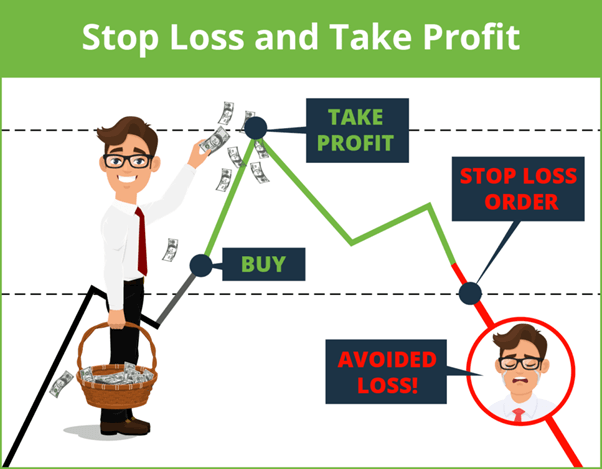

In forex trading, having a solid trading strategy is important to avoid losing money. Stop loss and take profit orders are two essential tools that can help traders manage risk and reward. These orders are used to limit losses and lock in a potential profit by setting a predetermined price target.

A stop-loss order is used to limit a trader’s losses in case the market moves against them. By setting a stop loss, the trader can avoid losing more than they are willing to risk. For example, if a trader buys the EUR/USD currency pair at 1.2000 and sets a stop loss at 1.1950, the trade will be automatically closed if the price falls to 1.1950. This means that the trader’s maximum potential loss will be 50 pips.

On the other hand, a take-profit order is used to lock in profits in case the market moves in the trader’s favour. By setting a take profit, the trader can ensure that they capture potential profit before the market reverses. For example, if a trader buys the EUR/USD currency pair at 1.2000 and sets a take profit at 1.2100, the trade will be automatically closed if the price rises to 1.2100. This means that the trader’s potential profit will be 100 pips.

The risk-to-reward ratio is an important concept to consider when using stop loss and take profit orders. This ratio is the potential profit divided by the potential loss. For example, if a trader sets a stop loss at 50 pips and a take profit at 100 pips, the risk-to-reward ratio would be 1:2. This means that the potential profit is twice the potential loss. It is generally recommended to use a risk-to-reward ratio of at least 1:2 to ensure that the potential profit is greater than the potential loss.

By using stop loss and take profit orders together and maintaining a favourable risk-to-reward ratio, traders can manage their risk and reward effectively. This is important for long-term profitability, especially if they have more losing trades than winning ones. For instance, if a trader has a win rate of 40% and a risk-to-reward ratio of 1:2, they can still be profitable. If they risk $100 on each trade, they will lose $400 on four losing trades and make $800 on six winning trades, resulting in a profit of $400. It’s worth to note that other factors, such as economic data, interest rates, political stability, central bank policies etc, can have a strong impact on trading.

Position sizing is a crucial aspect of trading in the forex market. It involves determining the appropriate amount of capital to risk on a particular investment based on the potential reward and the risk involved. One of the key factors to consider when determining position sizing is the risk-to-reward ratio.

The risk-to-reward ratio is a measure of the potential profit versus the potential loss of a trade. For example, if a trade has a risk to reward ratio of 1:2, it means that the potential profit is twice the size of the potential loss. Traders generally aim to have a risk to reward ratio of at least 1:2 or higher to ensure that their winning trades offset their losing trades.

When determining position sizing, traders need to consider their trading strategies, trade entry points, and price targets. For instance, a trader may have a trading strategy that involves placing stop-loss orders at a certain distance from the entry point to limit potential losses. They may also have specific price targets for taking profits. These factors can help a trader determine the appropriate position size for a particular trade.

For example, if a trader enters a long position on the EUR/USD at 1.2000 with a stop-loss order at 1.1950 and a price target at 1.2200, they will have a potential profit of 200 pips and a potential loss of 50 pips. If they are willing to risk 1% of their trading account on this trade, they would need to calculate their position size based on the risk to reward ratio of 1:4 (200 pips potential profit divided by 50 pips potential loss). This would result in a position size of 0.25 lots on a $10,000 trading account.

In summary, position sizing is a crucial component of risk management in the forex market. Traders need to consider their trading strategies, trade entry points, and price targets when determining the appropriate position size for a particular trade. The risk-to-reward ratio should also be considered to ensure that the potential reward is greater than the potential risk.

Calculating the reward-to-risk ratio is an important step in managing risk when trading in the forex market. The reward-to-risk ratio, also known as the risk to reward ratio, is a metric used by traders to compare the potential profit of a trade to the potential loss.

To calculate the reward-to-risk ratio, you need to determine the potential profit and potential loss of a trade. The potential profit is calculated by identifying the trade entry point and the target price. The potential loss is calculated by identifying the stop loss level.

For example, let’s say you want to buy a currency pair at 1.2000, and you set a stop loss at 1.1900. You also set a target price of 1.2200. In this case, the potential profit is 200 pips (1.2200 – 1.2000), and the potential loss is 100 pips (1.2000 – 1.1900).

To calculate the reward-to-risk ratio, you divide the potential profit by the potential loss. In the example above, the reward-to-risk ratio is 2:1, which means that the potential profit is twice as large as the potential loss.

A high reward-to-risk ratio is generally considered desirable as it means that the potential profit is greater than the potential loss. However, it is important to keep in mind that a high reward-to-risk ratio does not guarantee success, as there is always a chance that the trade will not go as planned.

It is also worth noting that the reward-to-risk ratio can vary depending on the trader’s strategy and risk tolerance. Some traders may aim for a higher reward-to-risk ratio, while others may be comfortable with a lower ratio.

In conclusion, calculating the reward-to-risk ratio is an essential step in managing risk when trading in the forex market. By identifying the trade entry point and setting a stop loss level, traders can determine the potential profit and potential loss of a trade and calculate the reward to risk ratio.

When developing a trading strategy, it’s important to consider the risk to reward ratio and other factors such as economic data, interest rates, political stability, central bank policies etc , as they can greatly impact the overall profitability of the strategy. The risk to reward ratio is the relationship between the potential loss and potential gain of a trade. A good risk to reward ratio ensures that the potential reward is greater than the potential risk, which is key to a successful trading strategy.

Here are some steps to help you find the best risk-to-reward ratio for your trading strategy:

By following these steps, you can find the best risk-to-reward ratio for your trading strategy, which will help you maximize your profits and minimize your risks. It’s important to remember that the risk-to-reward ratio is just one factor in developing a successful trading strategy, and other factors, such as market analysis, risk management, and trade execution, are also important to consider.

Find out 8 trading strategies every trader should know: Swing Trading, Position Trading, Day Trading, Price Action Trading, Algorithmic Trading, News Trading,etc.

This article provides an overview of exit strategies in trading and why they are essential for long-term success.

This article explores gold trading strategies, providing insights into why you should trade gold, and an analysis of the advantages and disadvantages of each strategy.

Our customer services team is here to answer any of your questions. From technical how to questions, to general trading, we re here to help

When you sign up with us, we ll assign you a dedicated relationship manager to help you on your trading journey

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Please click here to view our Risk Disclosure.

Hantec Markets use cookies to enhance your experience on our website. By staying on our website you agree to our use of cookies.

You can access our Cookie Policy here

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Please click here to view our Risk Disclosure.

Hantec Markets use cookies to enhance your experience on our website. By staying on our website you agree to our use of cookies. You can access our Cookie Policy here

Hantec Markets is a trading name of Hantec Group.

This website is owned and operated by Hantec Markets Holdings Limited. Hantec Markets Holdings Limited is the holding company of Hantec Markets Limited and Hantec Markets Ltd.

Hantec Markets Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the UK (Register no: FRN 502635).

Hantec Markets Ltd. is authorised and regulated as an Investment Dealer by The Financial Services Commission of Mauritius (License no: C114013940).

The services of Hantec Markets and information on this website are not aimed at residents of certain jurisdictions, and are not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use may be contrary to any of the laws or regulations of that jurisdiction. The products and services described herein may not be available in all countries and jurisdictions. Those who access this site do so on their own initiative, and are therefore responsible for compliance with applicable local laws and regulations. The release does not constitute any invitation or recruitment of business.

Hantec Markets does not offer its services to residents of certain jurisdictions including the USA, Iran, Myanmar, North Korea and the United Arab Emirates.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

We are transferring you to our affiliated company Hantec Trader.

Please note: Hantec Trader does not accept customers from the USA or other restricted countries.