Contracts for Difference (CFD) trading is an excellent way for investors looking to tap into the global financial markets without owning the underlying assets. This derivative trading method allows traders to speculate on the price movements of various financial instruments, including forex pairs, indices, commodities, and stocks. However, like any trading endeavour, CFD trading requires knowledge, strategy, and discipline to succeed. In this article, we will provide you with some essential tips that can help you navigate the world of CFD trading and enhance your chances of success.

Understand the Basics

Before diving into CFD trading, it’s crucial to grasp the fundamental concepts. In a CFD trade, two parties – a trader and a broker – enter an agreement to exchange the difference between an asset’s opening and closing prices. This difference is settled in cash, eliminating the need for physical ownership, i.e. as a trader, you will never actually own the underlying asset. CFD trading spans various markets, including (but not exclusive to) forex, indices, commodities, and stocks. CFD trading enables traders to benefit from both upward and downward price fluctuations. It is also worth noting at this stage that some countries have actually banned CFDs, so it is worth checking if you will have access to CFDs. Investopedia has a map showing which countries allow CFDs here.

Different CFD Asset Classes

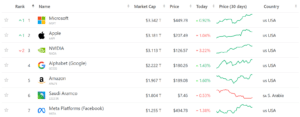

When engaging in Contracts for Difference (CFD) trading, traders are welcomed into a realm of remarkable diversity, where a multitude of asset classes are available to trade. This financial instrument offers a unique avenue for speculating on the price movements of various assets without owning them, making it possible to access a wide array of markets. Some of these asset classes include forex pairs, global indices, commodities, and stocks. Whatever you choose to trade, CFD trading can be done on a wide array of asset classes to suit traders’ preferences and strategies. Understanding the intricacies of each asset class empowers traders to craft well-informed decisions and potentially unlock profitable opportunities across the financial landscape.

Pros and Cons of CFD Trading

Now that you have a proper understanding of what CFD training entails, you should consider the pros and cons of CFD trading. We have compiled a list of these below.

Pros of CFD Trading

- Diverse Market Access: CFD trading provides access to a wide range of markets, including forex, indices, commodities, and stocks, allowing traders to diversify their portfolios and take full advantage of various asset classes.

- Leverage: CFDs offer the opportunity to trade with leverage, which means traders can control larger positions with a smaller initial investment. This can amplify profits if trades go in the desired direction.

- Short and Long Positions: CFDs enable traders to profit from both rising and falling markets. This flexibility allows for strategies like short selling, where traders can speculate on price decreases.

- No Ownership Required: CFD trading doesn’t require owning the underlying assets. Traders can profit from price movements without the hassle of managing physical assets.

- Global Market Exposure: CFDs provide access to international markets without the need to open separate brokerage accounts in different countries.

- Hedging: CFDs can be used as a hedging tool to offset potential losses in other investments by taking opposite positions in the CFD markets.

- Low Costs and Fees: CFD trading tends to incur less costs than more traditional trading methods.

Cons of CFD Trading

- Leverage Risk: Leverage magnifies profits, but it also magnifies losses as well. Traders can quickly lose more than their initial investment if the market moves against them.

- Complexity: CFD trading involves understanding complex financial instruments and market dynamics. It requires the knowledge of technical and fundamental analysis of a seasoned trader.

- Counterparty Risk: CFD trading involves a contractual agreement with a broker. If the broker faces financial difficulties, it could affect a trader’s ability to execute trades or withdraw funds.

- Regulatory Concerns: CFD trading regulations can vary by jurisdiction. Traders need to be aware of the regulatory environment and choose reputable brokers.

- Spreads: Some platforms that claim to be low-cost increase the spread of CFDs, which can significantly impact a trader’s potential returns.

Choose a Reliable Broker

Selecting the right broker is paramount in CFD trading. Look for a regulated and reputable broker that offers a user-friendly trading platform, competitive spreads, and good customer support. Ensure the broker provides access to a wide range of markets, some of which are listed above. Choosing the right broker is a pivotal decision that significantly impacts your trading journey, and it’s imperative to proceed with careful consideration. A reliable broker serves as your gateway to the financial markets, providing you with the tools, platforms, and support necessary to execute your trading strategies effectively. When evaluating potential brokers, there are several key things to avoid. Brokers with hidden fees, high minimum deposit costs, and that appear not to be regulated should be avoided. Trading CFDs on any of these “red flag” platforms will only exacerbate your problems.

Before committing to real capital, take advantage of demo trading offered by most reputable brokers. A demo account allows you to trade with virtual money, simulating real market conditions. This is an invaluable opportunity to test your strategies, get comfortable with the trading platform, and assess the broker’s services without risking your funds. Demo trading provides a risk-free environment for refining your skills and ensuring that the broker aligns with your trading needs. If you are looking to trade CFDs, you may already be an experienced trader and so may think you do not need to return to demo trading. However, it is a bad idea to get complacent. What harm can you do by familiarising yourself with CFDs before committing real capital?

Develop a Solid Trading Plan

A well-defined trading plan is the foundation of any successful trading, and it is no different when trading in CFDs. Determine your risk tolerance, trading goals, and preferred trading style (day trading, swing trading, or long-term investing). Your plan should include entry and exit strategies, risk management rules, and a clear outline of how much capital you’re willing to risk per trade. See Hantec’s excellent article about trading strategies for the Forex market, which can be easily adapted for CFD trading.

Stay Informed

Stay up-to-date with market news, economic indicators, and geopolitical events that can influence the financial markets. As a trader, you should be doing this anyway. You should know that market sentiment can change rapidly, and being informed will help you make well-informed trading decisions. Economic calendars and financial news websites can be valuable resources for staying informed. As CFDs are a relatively new product, the regulatory framework in any country can change fairly quickly, so also keep an eye out for this. A good summary of the UK’s regulatory framework surrounding CFDs can be found on the Forbes website here.

CFD Trading Top Takeaways

Contracts for Difference (CFD) trading presents a dynamic avenue for investors to engage with global financial markets, offering the potential for profit through price fluctuations without the burden of owning underlying assets. As we have explored in this article, CFD trading offers a range of benefits and considerations that can significantly impact trading outcomes. From the advantage of diverse market exposure and the potential leverage to amplify profits to the flexibility of profiting in both rising and falling markets, CFD trading opens doors to new opportunities. However, this realm also comes with its share of downsides, such as leveraging risks and regulatory considerations, underscoring the need for thorough research and understanding.

As you embark on your CFD trading journey, keep in mind the vital importance of understanding the basics, the pros and cons, and the critical role of selecting a reputable broker. By developing a solid trading plan, staying informed about market trends and economic indicators, and maintaining disciplined risk management, you can navigate the world of CFD trading with confidence. Remember that CFD trading, like any form of investment, requires dedication, continual learning, and the application of sound strategies to achieve your trading goals. With the right blend of knowledge and practice, CFD trading has the potential to become a rewarding and exciting venture on your financial journey.