Introduction to Trendlines for Beginners

Delve deeper into the use of trendlines in technical analysis. Learning how to read and identify a legitimate trendline can be very helpful. Hantec Markets is here to help.

Written by Aaron Akwu, Head of Education Hantec Markets

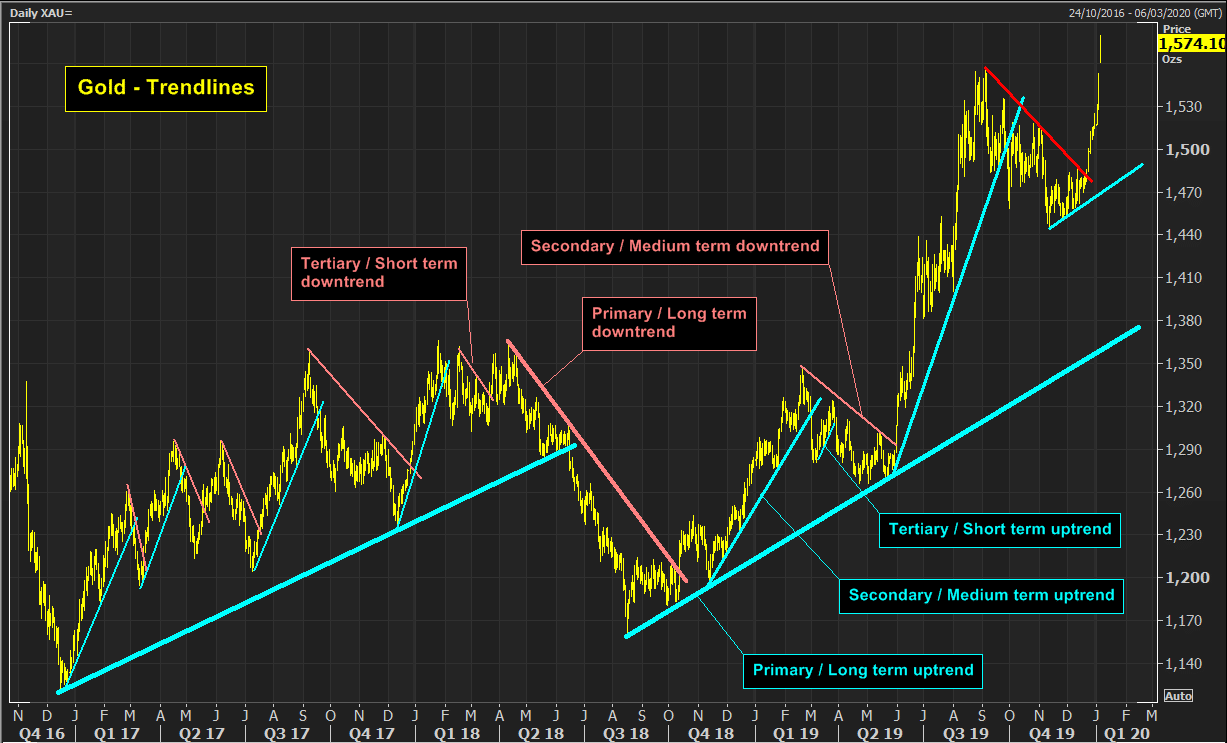

In the dynamic world of forex trading, analysing price movements is crucial for making informed decisions. One powerful tool used by traders is the trendline. Trendlines, also referred to as trend lines, are a fundamental component of technical analysis. They enable traders to identify and interpret trends in price charts visually. By connecting data values or data points on a price chart, trendlines provide valuable insights into a market direction, potential reversals, and future price movements. In this segment, we will look at the definition and purpose of trendlines in trading, shedding light on their significance and practical application. Additionally, Trendlines are among many other tools traders use to analyse price movements.

Definition and Purpose of Trendlines in Trading

A trendline is a straight line drawn on a price chart that connects multiple data points representing price highs or lows over a given period. It acts as a visual representation of the overall trend in the market. The process of drawing trendlines involves identifying significant swing highs and lows and drawing a line that best captures the direction and slope of the trend. Traders typically use trendlines to analyse and anticipate potential price movements, aiming to focus on trends as they develop.

The Purpose of Trendlines

Trendlines serve various purposes in trading, all aimed at providing traders with valuable insights and aiding decision-making. Let's explore some key purposes of trendlines:

1. Trend Identification:

One primary purpose of trendlines is to help traders identify the direction of the market trend. By connecting consecutive higher lows in an uptrend or lower highs in a downtrend, trendlines clearly illustrate whether the market is experiencing bullish or bearish momentum. This information is crucial for determining trading strategies and positions.

2. Support and Resistance Levels:

Trendlines also function as dynamic support and resistance levels. In an uptrend, a trendline acts as a support level, indicating potential buying opportunities when the price approaches or touches the trendline. Conversely, in a downtrend, the trendline acts as a resistance level, signalling potential selling opportunities. Traders often look for price reactions near trendlines to make trading decisions.

3. Trend Reversal Signals:

Trendlines can provide early signals of potential trend reversals. When a price chart breaks a well-established trendline, it may indicate a change in market sentiment and the possibility of a trend reversal. Traders pay close attention to such breakouts, as they can provide profitable trading opportunities. False breakouts, however, can cause losses if they are not properly confirmed.

4. Entry and Exit Points:

By drawing trendlines, traders can identify optimal entry and exit points for their trades. Trendline breakouts or bounces can act as triggers for entering or exiting positions. For instance, a trader may consider entering a long position when the price successfully bounces off an ascending trendline, indicating a continuation of the upward trend.

How Trendlines are Drawn on Price Charts

Determining a Valid Trend Line

To draw a valid trend line, it is essential to select the appropriate price points. Generally, a valid trend line requires at least two significant swing highs or swing lows to be connected. A swing high represents a peak in price, while a swing low corresponds to a trough. By connecting these critical points, the trend line begins to take shape.

Drawing Trend Lines

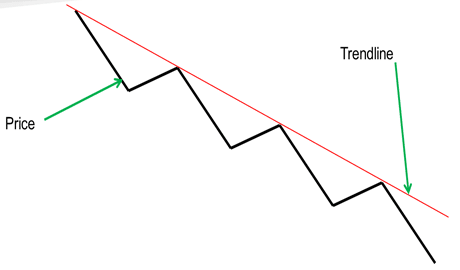

The process of drawing trend lines involves carefully analysing price movements and selecting the most appropriate swing highs and lows to connect. Start by identifying the prevailing trend - whether it is an uptrend (higher highs and higher lows) or a downtrend (lower highs and lower lows).

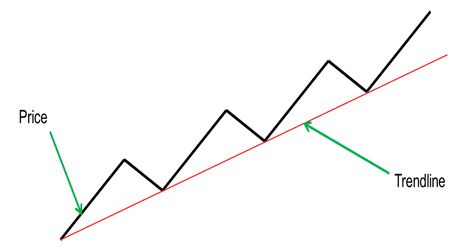

For an uptrend, locate the significant swing lows and draw a straight line connecting them. This line acts as a support level, indicating potential buying opportunities. Conversely, for a downtrend, identify the crucial swing highs and connect them with a straight line, which acts as a resistance level, suggesting potential selling opportunities.

Types of Trendlines

Let's explore the different types of trendlines:

1. Upward (Bullish) Trendlines

An upward trendline is drawn by connecting a series of higher swing lows, indicating an overall upward movement in prices. It serves as a visual representation of the support level for an asset. Traders often use upward trendlines to identify potential buying opportunities and determine the strength of an uptrend. These trendlines are by a positive slope and act as a guide for setting stop-loss levels or identifying areas of potential price support.

2. Downward (Bearish) Trendlines

On the flip side, a downward trendline is formed by connecting a series of lower swing highs, indicating a downward movement in prices. It represents a resistance level where selling pressure outweighs buying pressure. Downward trendlines have a negative slope and can be useful for identifying potential selling opportunities or determining the strength of a downtrend. Traders often use them to set profit targets or identify areas where prices may encounter resistance.

3. Horizontal (Sideways) Trendlines

Unlike upward and downward trendlines, which display a clear directional bias, horizontal trendlines depict periods of consolidation or a lack of a defined trend. They are drawn by connecting a series of swing highs or swing lows that occur around a similar price level. Horizontal trendlines are valuable for identifying key support and resistance levels within a sideways market. Traders pay close attention to these levels as they can provide insights into potential breakout or breakdown points when the price eventually breaks through horizontal support or resistance.

In addition to these basic trendlines, there are other variations that traders may, such as curved lines, exponential trendlines, and uptrend lines. A curved line is drawn by fitting the trendline to the price movements in a way that captures the overall curvature of the trend. Exponential trendlines give more weight to recent price movements, and the current trend's momentum. Uptrend lines are similar to upward trendlines but are drawn at a steeper angle, indicating a stronger upward momentum.

Mastering the Art of Drawing Trendlines in Technical Analysis

Drawing trendlines is an essential skill in technical analysis, allowing traders and analysts to identify and validate trends in price movements.

Connecting Swing Lows and Swing Highs

One of the fundamental principles of drawing trendlines is to connect swing lows and swing highs. A swing low occurs when a price reaches a temporary low point amidst a rising trend, followed by a subsequent upward movement. Conversely, a swing high happens when a price reaches a temporary high point during a downward trend, followed by a subsequent downward movement.

To draw a linear trendline, we connect two or more swing lows or swing highs by extending a line through the price points. This line represents the overall direction of the trend and acts as a visual guide for traders. By connecting these key points, we can identify the general direction in which the price is moving.

Using Multiple Points to Validate Trendlines

While drawing trendlines, it is crucial to incorporate multiple swing lows or swing highs to validate the accuracy of the trendline. Relying on a single point may lead to false interpretations, as it might not fully represent the broader trend.

By incorporating additional swing lows or swing highs, we create a more robust trendline that withstands market fluctuations. These points act as supporting evidence, confirming the strength and validity of the trendline. The more points that align with the trendline, the more reliable it becomes as an indicator of the prevailing market trend.

Adjusting Trendlines Based on Price Action

Price action plays a vital role in determining the effectiveness of a trendline. As new price data becomes available, it is essential to reassess and adjust the trendline accordingly. Price action may lead to the emergence of new swing lows or swing highs, altering the slope and position of the trendline.

Traders should regularly review and adjust their trendlines to account for significant price movements. If a trendline is consistently violated or fails to capture the latest price dynamics, it may be necessary to redraw or readjust the trendline to better reflect the current market conditions.

Identifying Breakout Opportunities Using Trendlines

By drawing a linear trendline, we can identify potential breakout opportunities. The process involves locating areas where the price is consistently reaching the trendline but fails to break through it. These instances suggest that a breakout may occur when the price eventually breaches the trendline.

Confirmation Signals for Trendline Breakouts

While spotting a trendline breakout candidate is a great starting point, it is crucial to seek confirmation signals before executing a trade. Confirmation signals provide additional evidence that strengthens the likelihood of a successful breakout. Traders often look for indicators such as increased trading volume, bullish chart patterns like the cup and handle formation, or momentum indicators like the Relative Strength Index (RSI) showing bullish divergence. These signals validate the potential breakout and provide traders with more confidence in their trading decisions.

Managing Risk and Setting Stop-Loss Orders for Breakout Trades

Risk management is a fundamental aspect of any trading strategy, and breakout trades are no exception. Setting appropriate stop-loss orders is essential to protect capital and limit potential losses. When initiating a breakout trade, traders often place a stop-loss order slightly below (buy) or above (sell) the breakout level. This ensures that if the breakout fails and the price retraces, the trade is automatically exited, preventing excessive losses. Additionally, trailing stop-loss orders can be employed to lock in profits as the price continues to move in the desired direction.

Trendline Support and Resistance

Identifying Support and Resistance with Trendlines

Trendlines serve as visual guides that connect significant swing highs or lows on a price chart, showcasing the overall trend direction. When drawn accurately, these lines also reveal potential support and resistance areas. Support refers to a price level where buying pressure tends to prevent the price from falling further, while resistance represents a level where selling pressure halts the price's ascent.

Bounce Plays: Trading at Trendline Support or Resistance

One common strategy is the bounce play, which involves entering trades when the price reaches a trendline support or resistance level. When the price approaches trendline support, it indicates a potential buying opportunity, as historical price action suggests that demand has historically overwhelmed supply at that level. Traders can consider initiating long positions, anticipating a price rebound from the support level.

Conversely, when the price nears a trendline resistance, it implies a potential selling opportunity. The historical significance of this level suggests that supply has previously surpassed demand, resulting in price reversals. Traders may consider short positions, hoping to profit from a potential price retreat from the resistance level.

Breakdown Plays: Trading Breakouts Below Trendline Support or Resistance

Breakdown plays involve trading breakouts below trendline support or resistance levels. When the price decisively breaches trendline support, it indicates a potential trend reversal or a significant shift in market sentiment. Traders may view this as an opportunity to enter short positions, aiming to on a potential downtrend.

Similarly, when the price breaches a trendline resistance, it suggests a breakout to the upside, potentially indicating a bullish trend reversal. Traders can consider entering long positions, anticipating further price appreciation beyond the resistance level.

Limitations of Trendlines and the Role of Polynomial Trendlines

1. False Breakouts and Whipsaws

One of the major limitations of traditional trendlines is the occurrence of false breakouts and whipsaws. A false breakout happens when the price briefly moves beyond a trendline but quickly reverses its direction, giving a false indication of a new trend. Whipsaws, on the other hand, occur when the price moves back and forth across a trendline, resulting in multiple false signals. These false breakouts and whipsaws can lead to unreliable trading signals and potentially result in losses for traders relying solely on trendlines.

2. Drawing Subjective Trendlines

Another limitation of trendlines lies in their subjective nature. Since trendlines require manual drawing, there is room for interpretation and subjectivity. Different traders may draw trendlines differently, leading to variations in trendline placement and potentially conflicting signals. This subjectivity can introduce inconsistency and confusion, especially when multiple traders are the same chart. Consequently, it is important to exercise caution and consider other technical indicators or analysis methods alongside trendlines.

3. Adjusting Trendlines in a Trending Market

Trendlines are most commonly used to identify and validate trends. However, in a rapidly trending market, it can be challenging to adjust trendlines accurately. As prices continue to rise or fall, the optimal placement of a trendline can change, making it difficult to keep up with the evolving trend. Traders may need to continuously adjust and redraw trendlines, which can be time-consuming and prone to errors. Failing to adapt trendlines to changing market conditions may result in missed opportunities or false interpretations of the ongoing trend.

Introducing Polynomial Trendlines

To address some of the limitations associated with traditional trendlines, traders often turn to Polynomial Trendlines. A Polynomial Trendline is a curve-fitting technique that uses a mathematical formula to approximate the price movement. Unlike straight trendlines, which are linear, Polynomial Trendlines can capture more complex price patterns. However, they have their own limitation and may not provide better results than linear trendlines. By fitting a polynomial function to the data, these trendlines offer a smoother representation of trends and may help mitigate false breakouts and whipsaws to some extent.

Balance Guard

Balance Guard