If you are new to trading forex and you find the whole process of trading rather daunting, you might like the idea of using a tech solution to do the whole thing for you. Forex trading robots or bots are an increasingly popular tool for traders. We will explain what trading robots are and how they are used. If you are interested in weighing up the decision whether to use one, we’ve also got some pros and cons for you too.

What is a Forex Trading Robot?

A forex trading robot is a plugin tool that traders bolt onto their trading systems to analyse markets and make their trading decisions. The systems are based on software programs that are designed to trigger trading decisions when certain parameters have been met.

An Expert Advisor (or EA for short) is the most common type of forex trading robot, coming on the ubiquitous MetaTrader 4 and 5 platforms. EAs can be programmed to trade automatically. Traders can develop their automated trading systems, which are created by the MQL programming language.

Developing your system can take considerable time to get right, deciding upon the parameters, indicators and signals to incorporate. Furthermore, backtesting is an extremely important part of the process too. Despite this, though, one of the benefits of developing your automated trading systems is that systems can be tweaked and fine-tuned as market conditions change.

However, some traders might like to go for the easier alternative option, which is to use a ready-made trading robot. Other trading bots can be purchased online and bolted on to run your trading account for you.

There are various types of trading robots on the market. Some offer hedging strategies, and some allow the user to adapt to their preferences. If you are interested, look into the details of what they are offering and see what suits your trading style.

How Much Do They Cost?

The price that you can pay for a forex trading robot can vary enormously. However, it is possible to obtain trading robots for free. Some EAs on MT4/MT5 are free, whilst there are other free bots available online via trading websites too. However, EAs that you do yourself will need to be programmed, whilst the free robots are also fairly limited in their functionality.

Other robots will cost money to use. Generally, the more you pay, the better the features or reliability of the robot. The more basic ones will be cheaper; some can be less than $100 to buy. However, the top-performing robots come with a cost upwards of $300 to $400.

You should also be aware that whilst some come with a one-off fee, some also come with monthly subscriptions or fees for continued access. It is best to look at the small print before choosing which is best for you.

Pros and Cons of Trading with Robots

Using trading robots can be especially appealing to forex traders for several reasons. However, there are also factors to be aware of that might make traders think twice about the option of using a robot. Here are a few pros and cons.

Pros

Let’s start with the benefits of using forex trading robots.

1) Robots allow you to trade 24 hours a day

Forex markets are open 24 hours a day, five days a week. Trading with robots allows you to stay active in forex markets even when you are asleep or just if you’ve got other things to do in your life. You no longer need to be glued to your screen for the whole day.

2) Robots make decisions much faster than human traders

Forex trading robots enable the scanning and analysis of markets to be done in a matter of seconds for what might take humans several minutes. These are important time-saving devices that can be the difference between a profit and loss to day traders.

3) Take the emotion out of trading

One of the big negatives of trading is how it makes you feel, especially when you feel that you’ve made a mistake that’s cost you money. It can play havoc with your emotions. Forex robots can help to take the emotion out of trading. After all, it’s automated, and it’s not your call. This can be very helpful for a lot of traders.

Cons

We have discussed some of the positives of using forex trading robots. However, what about the negatives? Here are a few of the cons.

1) Market conditions are ever-changing

Forex Trading Robots use a fixed set of algorithms. But what if market conditions change? The algorithms would have been written during a certain set of market conditions and then back-tested to check performance through several months or even years of trading. However, what if market conditions change dramatically?

Forex robots designed in 2019 would have been faced with a significantly different set of market conditions when the pandemic hit in February 2020. Volatility in forex markets increased significantly in 2022 and into 2023 as central banks tightened monetary policy aggressively. The unprecedented impact of this upon forex markets would have seen forex trading robots having to cope with conditions not seen for decades.

2) Trading robots are not foolproof

Whilst the robots are fully backtested, it is important to remember that they are not a guarantee to success in the forex market. Periods of drawdown, when trades go wrong, are inherent in any trading system. The timing of your use of the system can be a key determining factor behind profit or loss, at least over the near to medium term.

3) Scam robots

Anyone who checks their emails regularly will be aware that there are nefarious chancers out there, trying to catfish us into parting with our hard-earned money. Unfortunately, the world of forex is not immune to scammers either.

The forex trading robot scams include using fake or cooked figures to lure traders into paying for their products. There is nothing hard and fast when it comes to whether a forex trading robot can be trusted. A decent rule of thumb is when something sounds too good to be true, then it probably isn’t. No trading robot will give exceptional results as they are rigid tools amid the constantly changing market conditions. Avoiding scam robots is difficult, but we recommend using software that has been independently tested. Furthermore, to make it even harder, reviews can also be misleading as they can be paid for. It can be a bit of a minefield when it comes to buying forex trading robots.

The Impact of Machine Learning and AI Algorithms on Forex Trading

Automated trading systems with the integration of artificial intelligence and machine learning are an important development in the forex trading world. They bring speed and superior analytical skills to spot the trends and correlations in pattern recognition and directional breaks. They remove human biases inherent in decision-making and enable huge volumes of data to be analysed at significantly faster speeds than humans can ever achieve. It also helps to improve risk management, with the speed and execution of trades that allow the systems to take advantage of the smallest of inefficiencies in markets.

However, there will always be a role for humans to play too. The value of human expertise in the oversight of trading systems should not be dismissed. Machine learning or AI is also not yet able to incorporate the human traits of market insight and context to trading forex. For example, how does a bot respond when the seemingly counterintuitive reaction of “when good news is bad” is prevailing in the market?

Furthermore, what if the data that the algorithms are based upon turns out to be flawed or simply incomplete? Unforeseen events can significantly change market responses and make them react in unusual ways. If these factors are not incorporated into the AI bots, then human insight and expertise can be important in navigating these moments.

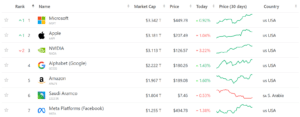

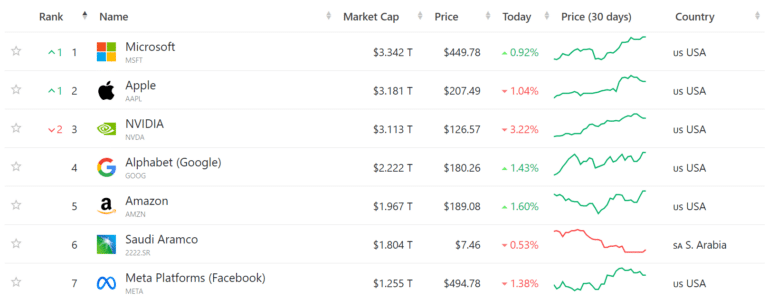

What is undeniable, though, is that machine learning and AI tools will become an ever more important factor in the forex markets and the wider financial industry. The forex industry is becoming ever more dominated by traders using robots. Statistics vary on their usage. According to the Bank for International Settlements, in the ten years since the introduction of EAs to the forex market, by October 2020, around 10% to 20% of global spot forex trading was through EAs. Other statistics have their usage much higher. However, what is undeniable is that given the popularity of EAs in recent years and technology enhancements, the usage of AI and bots in forex trading will only continue to rise.

Forex Trading Robots Takeaways

If you are looking at using a forex trading robot, it is important to look at the reviews and do some digging around on authoritative testimonial sites. That way, you should be able to gain a more informed view of the robot you are looking at.

It remains controversial whether robots can generate profits. You have to wonder if some of these systems made the profits they claim and whether the developers would be telling anyone about them. Furthermore, often it is a question of timing. Some will make profits over short time horizons, but when markets reverse, they struggle to sustain the profits.

Despite this, though, there is an appetite for algorithm trading and trading robots. If you are interested, as ever with these things, it is important to do your research before making a decision on which one to buy. Also, relying on the trading robot for all your trading requirements may not be the best way to go. There is still a place for learning to trade forex the traditional way. Human knowledge and expertise will always have a big role in the forex markets of the future, whatever artificial intelligence throws at us.