A Beginner's Guide to Trading Psychology

Written by Aaron Akwu, Head of Education Hantec Markets

What is Trading Psychology?

Trading psychology is an essential aspect of becoming a successful trader. Trading psychology refers to the mental and emotional state of a trader and how it affects their decision-making process while trading. For beginners, understanding the importance of trading psychology is crucial to developing a successful trading career.

One of the key elements of trading psychology is having a solid trading strategy. A trading strategy is a set of rules and guidelines that a trader follows to enter and exit trades. It helps traders make informed decisions and minimizes the impact of emotions on their trading.

Another essential component is having a trading plan. A trading plan outlines a trader’s goals, risk management strategies, and other important aspects of their trading journey. It helps traders stay focused and disciplined, even when faced with unexpected market conditions.

Successful traders understand the importance of discipline and emotional control. They know that emotional trading can lead to poor decision-making and significant losses. By keeping their emotions in check and sticking to their trading plan, successful traders can make more objective decisions and avoid the pitfalls of emotional trading.

On the other hand, losing traders often fall victim to emotional trading. They may let their emotions dictate their trading decisions, leading to poor outcomes. They may also lack the discipline to stick to their trading plan or may not have a solid trading strategy in place. It’s important for beginners to understand the common mistakes made by losing traders and strive to avoid them.

Importance of Developing Trading Psychology

Developing trading psychology is essential for beginners who want to succeed in the currency/stock market. It involves training your mind to make rational decisions based on facts, not emotions. Here are some reasons why developing trading psychology is crucial for beginners:

- Helps you handle losing trades: Losing trades are inevitable in the financial market, and they can be emotionally draining for beginners. Developing trading psychology helps you handle these losses and prevent them from affecting your future trades.

- Teaches you discipline: To succeed in the market, you need to be disciplined and consistent in your approach. Developing trading psychology helps you stay disciplined and avoid impulsive decisions that can lead to losses.

- Builds confidence: Confidence is crucial when trading in the financial market. Developing trading psychology helps you build confidence in your abilities and trading strategies, which can lead to better trading success.

- Encourages self-reflection: A trading journal is a useful tool for self-reflection and improving your trading psychology. By analyzing your trades and emotions, you can identify patterns and areas for improvement.

- Enhances decision-making skills: Trading psychology helps you make better decisions based on facts and logic rather than emotions. This skill is essential for successful trading in the market.

Psychology Behind Trading

To succeed as a trader, it is important to understand the psychology behind trading, including how emotions, biases, personality traits, and external pressures can impact trading decisions.

Here are some key points to consider:

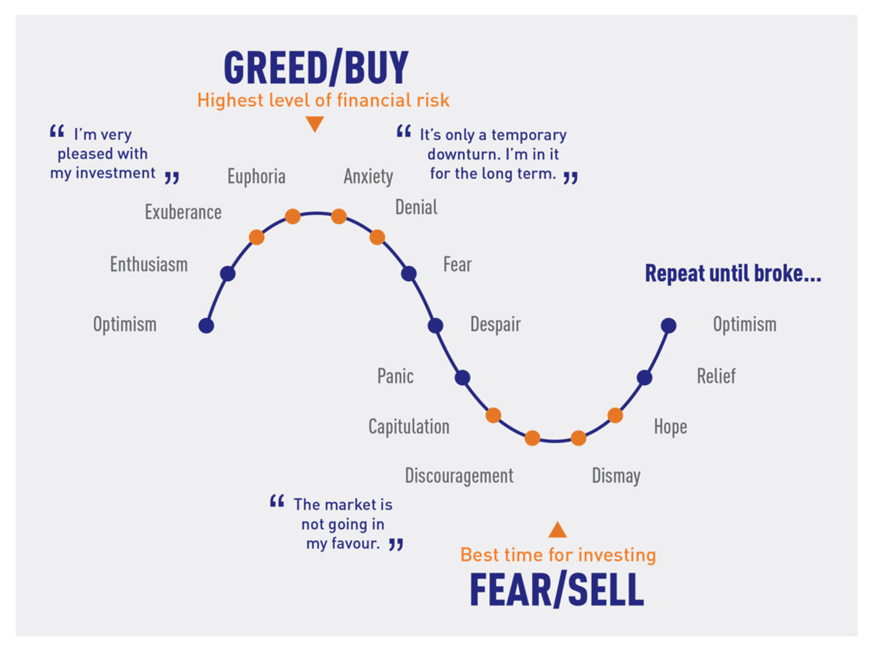

- Emotions: Trading can elicit a range of emotions, including fear, greed, excitement, and frustration. These emotions can cloud judgment and lead to impulsive decisions, such as entering or exiting trades too soon or too late. It is important to be aware of these emotions and learn to manage them effectively to avoid making irrational decisions that can result in losing trades and losing money.

- Biases: Traders can also fall prey to cognitive biases, such as confirmation bias (seeking out information that confirms one’s pre-existing beliefs) and overconfidence bias (overestimating one’s abilities and underestimating risks). These biases can lead to faulty analysis and decision-making, which can result in significant losses.

- Personality Traits: Different personality traits can impact a trader’s behavior and decision-making. For example, risk-averse individuals may be more hesitant to take on trades with high risk, while those who are prone to impulsivity may be more likely to take on risky trades without proper analysis. Understanding one’s own personality traits and how they impact trading can help traders make better decisions and develop more effective trading strategies.

- External Pressures: Traders may also face external pressures, such as pressure from peers, family members, or the media, which can influence their trading decisions. Additionally, traders may feel pressure to make up for losses or meet certain performance metrics, which can lead to impulsive and risky trades.

To overcome these challenges, it is important to develop effective trading strategies, which can be honed through practice trading. By practicing with virtual money or in a simulated environment, traders can develop the skills and knowledge needed to make informed decisions and manage emotions and biases effectively.

How to Improve Trading Psychology

Improving your trading psychology is an essential aspect of becoming a successful trader. It involves cultivating a strong mindset that can withstand the emotional ups and downs that come with trading. One of the most challenging parts of trading is dealing with a losing trade. It’s easy to feel discouraged or frustrated when you see your account balance decrease after making a trade that didn’t go as planned. However, it’s crucial to understand that losing trades are a natural part of trading, and everyone experiences them at some point.

To improve your trading psychology, you must learn to manage your emotions effectively. One of the best ways to do this is to develop a solid trading plan and stick to it. A well-crafted trading plan will outline your entry and exit points, as well as your risk management strategy. By having a plan in place, you’ll be less likely to make impulsive decisions based on emotions.

It’s also important to evaluate your own trading psychology regularly. Take the time to reflect on your past trades and how you reacted to them emotionally. If you find that you’re getting too emotional about your trades, consider taking a step back and reassessing your strategy. It’s okay to take a break from trading if you need to clear your head and refocus.

Another effective way to improve your trading psychology is to surround yourself with like-minded individuals. Joining a trading community or finding a mentor can provide you with the support and encouragement you need to stay motivated and focused on your goals. You’ll also have the opportunity to learn from others’ experiences, which can be incredibly valuable.

Improving your trading psychology is an ongoing process that requires self-reflection, discipline, and a commitment to continuous learning. By developing a strong mindset and sticking to your trading plan, you’ll be better equipped to handle the emotional challenges that come with trading, including losing trades. Remember to stay positive, stay focused, and keep working on yourself to become the best trader you can be.

Trading psychology mistakes and how they may negatively impact a trader's decision-making process

Trading psychology plays a crucial role in a trader’s success or failure in the financial markets, especially in forex trading. To master trading psychology is very essential because it helps traders to make rational decisions, manage emotions, and avoid making costly mistakes that can lead to losses.

One of the most common trading psychology mistakes is letting emotions drive trading decisions. Many traders tend to let fear, greed, or hope cloud their judgment, leading to impulsive trading decisions that can negatively impact their trading performance. For instance, a trader may enter a trade without proper analysis or exit a trade too early or too late due to emotional reactions.

Another mistake that traders make is trading without adequate trading knowledge or skills. Trading is not a get-rich-quick scheme, and traders need to put in the effort to learn about the markets, trading strategies, and risk management. Trading without sufficient knowledge or skills is like gambling, and traders are likely to lose money in the long run.

Furthermore, trading without a risk-free demo account is a recipe for disaster. A demo account is an essential tool for traders to practice and test their trading strategies in a simulated trading environment without risking real money. By using a demo account, traders can gain experience and confidence before trading with real money.

Finally, traders who ignore risk management principles are also likely to lose money. Risk management involves setting stop-loss orders, position sizing, and taking calculated risks. Traders who ignore risk management principles are likely to blow their trading accounts and suffer significant losses.

Mastering trading psychology is crucial for any trader who wants to succeed in forex trading or any other financial market. Traders must avoid emotional trading decisions, acquire adequate trading knowledge and skills, use a risk-free demo account to practice, and implement proper risk management principles to avoid costly mistakes and losses.