Updated on June 2023 by Sharon Lewis.

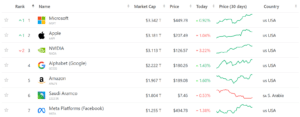

The impact of the world’s largest companies is far-reaching, well beyond the borders of the countries that they reside in. Often, when thinking about these companies, we are drawn to the US, with 50% of the world’s largest companies by market capitalisation originating from the US alone.

However, global markets beyond the US are increasingly drawing attention as investment destinations. It is, therefore, important for investors and traders to be aware of key information about the largest companies that originate from outside the US.

In this article, we will look at:

How do we define the largest?

We rank the size of these companies by their market capitalisation (also known as equity value), defined by multiplying the share price of a company by its total number of outstanding shares. This value provides investors/traders with information on the public’s perception of a company’s value, allowing them to make informed decisions when investing/trading.

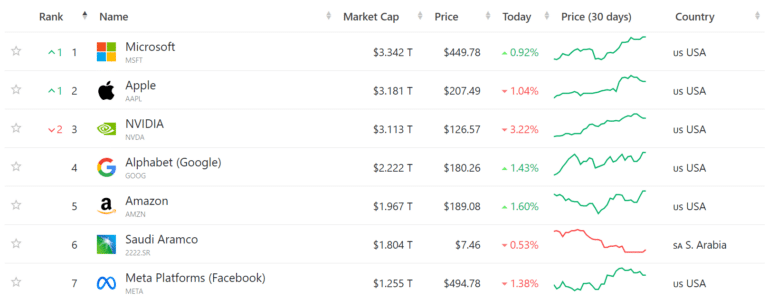

Ten Largest non-US companies[1]

| Rank | Company | Country | Market Capitalisation ($billions) |

|---|---|---|---|

| 1 | Saudi Aramco | Saudi Arabia | 2071 |

| 2 | TSMC | Taiwan | 542 |

| 3 | LVMH | France | 471 |

| 4 | Tencent | China | 443 |

| 5 | Samsung | South Korea | 370 |

| 6 | Novo Nordisk | Denmark | 363 |

| 7 | Nestlé | Switzerland | 324 |

| 8 | Kweichow Moutai | China | 306 |

| 9 | ASML | Netherlands | 288 |

| 10 | Roche | Switzerland | 249 |

1. Saudi Aramco (2222.SR)

The largest non-US company (and also the third largest in the world) is Saudi Aramco, a majority state-owned petroleum and natural gas company from Saudi Arabia with a market capitalization of $2.071 trillion. The only companies larger than Saudi Aramco are tech giants Apple and Microsoft.

Saudi Aramco is the largest oil-producing company in the world, managing over 100 oil and natural gas fields. It is the largest single carbon-producing company in the world.

Founded in 1933 in Saudi Arabia, Saudi Aramco has a chequered past, initially being owned as a subsidiary by the American company Standard Oil of California (SoCal). In 1976, due to heightening political tension in the Middle East, the Saudi Arabian government took full control of Saudi Aramco assets. In 2019, 5% of Saudi Aramco’s ownership was allowed to be traded publicly in an initial public offering (IPO). This IPO became the world’s largest, with the company managing to raise $25.6 billion on Saudi Arabia’s Tadawul stock exchange.

Saudi Aramco’s headquarters are in Dhahran, Saudi Arabia, and the CEO is Amin H. Nasser, who has held the position since 2015. In 2022, due to rising oil prices, Saudi Aramco recorded a historic $161.1 billion in net income.

2. TSMC (TSM)

Second on our list is the Taiwanese Semiconductor Manufacturing Company (TSMC), the world’s oldest and largest semiconductor fabrication plant. TSMC was founded in 1987 by Morris Chang, who only retired in 2018 and was succeeded by C. C. Wei as CEO and Mark Liu as Chairman. TSMC is listed on the Taiwanese Stock Exchange and the New York Stock Exchange (the first Taiwanese company to achieve this). TSMC’s customers include Apple, Arm and NVIDIA.

That being said, TSMC’s key competitors also include NVIDIA, as well as Intel and Texas Instruments, to name a few.

With headquarters located in Hsinchu in Taiwan, TSMC is often impacted by geopolitical conflicts, and so TSMC has been attempting to mitigate this by expanding across the globe. The company grossed $75 billion in 2022.

3. LVMH (MC)

The first European company on our list is LVMH Moët Hennessy Louis Vuitton (LVMH), a French multinational that was formed through a merger between Louis Vuitton (the luxury fashion brand) and Moët Hennessy (the luxury drinks brand). LVMH specialises in luxury brands, and its subsidiaries include Dior, Givenchy, Kenzo, and Tiffany & Co.

LVMH was formed in the 1980s by Bernard Arnault (who remains as CEO to this day) in an effort to conglomerate prestigious brands. Arnault is currently the richest man in the world, overtaking Tesla founder and tech billionaire Elon Musk.

The only majority shareholder in LVMH is the Arnault Family Group. LVMH is headquartered in Paris. In 2019, LVMH had a legal battle with Tiffany & Co. over LVMH’s proposed acquisition of the jewellery company. The companies ultimately came to an agreement, and the full purchase of Tiffany & Co. was completed in early 2021. More recently, LVMH has begun to embrace blockchain technology and the concept of Non-Fungible Tokens (NFTs).

LVMH has major competitors across the many industries that it operates in, including Christian Dior (fashion) and Remy Cointreau (liquor). In April this year, LVMH became the first European company to surpass a market cap of $500 billion.

4. Tencent (TCEHY)

Next, we have Tencent, a Chinese multinational conglomerate founded in 1998 by Pony Ma (who remains as CEO and Chairman), Charles Chen, Zhang Zhidong, Xu Chenye, and Zeng Liqing. It is based in Shenzhen, China. Tencent provides services in sectors such as social networks, video games, and music, and holds stakes in well over 500 companies.

Since 2011, Tencent has provided the social media app WeChat, which has an active user count of over 1 billion. In 2015, Tencent branched out and created the online bank WeBank. It also owns the games company Riot Games (developer of League of Legends), has majority stakes in many companies, including Supercell (developer of Clash of Clans), and minority stakes in other companies such as Epic Games (developers of Fortnite).

The company recently struck a multi-year deal with Formula 1 to stream F1 events on its platforms during 2024. Tencent also held rights as an official broadcaster of the 2021/2022 NBA regular season in mainland China.

Last year, Tencent began aggressively buying its own shares in an attempt to stop the price from sliding following an announcement by Prosus (a large shareholder in Tencent) that it would sell some of its stake in Tencent. Tencent’s revenue fell 1% in 2022, touching $81 billion.

5. Samsung (005930.KS)

Continuing from Asia, we have South Korean Samsung at number five. Samsung was founded in 1938 by Lee Byung-Chul but did not enter the industries that would cause it to become one of the world’s largest companies until the 1960s and 1970s, when Samsung entered the electronics, construction, and shipbuilding industries.

Samsung is based in Seoul, South Korea, and its chairman is Lee Jae-Yong, son of former chairman Lee Kun-Hee.

The group’s revenues are largely driven by Samsung Electronics, one of the largest technology companies in the world.

Samsung Electronics produces all types of electronic devices, including smartphones and tablet computers. It is the world’s memory chips, smartphones and TVs. The company recently reported that its operating profits had slid 69% in Q4 2022, the lowest in eight years, as the semiconductor industry took a hit.

Other affiliates of Samsung include Samsung Heavy Industries, Samsung Biologics and Samsung Engineering.

6. Novo Nordisk (NVO)

Novo Nordisk is a pharmaceutical company from Denmark with headquarters located in Bagsværd. Novo Nordisk specialises in diabetes treatments but also is involved in areas such as haemostasis, growth hormone therapy and hormone replacement therapy. Novo Nordisk was created in 1989 following a merger between Novo Industri and Nordisk Gentofte, allowing Novo Nordisk to become the world’s largest producer of insulin. The Chairman of Novo Nordisk is Helge Lund, and the CEO and President is Lars Fruergaard Jørgensen. About a third of Novo Nordisk’s revenue is made up of insulin sales, but they are attempting to move into higher-growth treatment areas.

Competitors of Novo Nordisk include Roche, Pfizer, and Sanofi. Novo Nordisk reported an annual revenue of $26.4 billion for the year ended 31 March 2023. This is a year-on-year increase of 13.54% from 2022.

7. Nestlé (NESN)

In seventh place, we have Nestlé, based in Vevey in Switzerland. Nestlé is the largest food company in the world, operating in 189 countries, and is entirely publicly held.

Nestlé was founded in the late 19th century after a merger between two Swiss food and beverage enterprises. Over the course of the 20th and 21st centuries, Nestlé continued to grow with further acquisitions, mergers, and international expansion. Nestlé’s largest brands include Nespresso, Kit Kat, and Maggi, and Nestlé also has majority stakes in other large companies, including L’Oreal. The company has had a controversial past, with them continuing to face the consequences due to their marketing of baby formula and use of child labour.

Recently, the company received approval for the acquisition of the Brazil-based chocolate company Garoto after a 20-year-long legal battle.

Nestlé’s competitors consist of other large providers of food and drink products, including Kerry, Unilever, and PepsiCo. The company made $99.32 billion in revenues during 2022, an increase of 3.78% from the previous year.

8. Kweichow Moutai (600519.SS)

Based in Maotai in China, Kweichow Moutai is the world’s largest beverage company. Kweichow Moutai is partially owned by the Chinese government and partially publicly owned, with the Kweichow Moutai Group having the majority share. It has been listed on the Shanghai Stock Exchange since 2001. Kweichow Moutai produces Maotai, a baijiu (Chinese liquor) which is immensely popular, with 70,200 tons being produced in 2018 alone.

Kweichow Moutai has been seeing an average revenue growth rate of 15-16% for the past 6 years, with revenues reaching $18.17 billion in 2022.

9. ASML (ASML)

ASML is a leading Dutch semiconductor equipment manufacturer specialising in lithography systems used in the production of integrated circuits. In 2023, the company made significant strides by introducing its latest breakthrough, the next-generation Extreme Ultraviolet (EUV) lithography system. This development enables the production of even smaller and more powerful chips, reinforcing ASML’s position as an industry leader and a catalyst for semiconductor advancements.

ASML experienced substantial growth in recent years, generating a revenue increase for nine years in a row. It made $23 billion in net sales during 2022, an increase of 17% compared to the previous year.

10. Roche (ROG)

The second Swiss company on our list is F. Hoffmann-La Roche AG (Roche), which is a healthcare company that was founded in 1896. Descendants of the founders, the Hoffman and Oeri families, own just over half of the shares with voting rights in Roche. Roche is the fifth largest pharmaceutical company in the world and can be separated into two major divisions, Pharmaceuticals and Diagnostics.

Roche is the world’s largest spender in medical research and development and develops drugs to treat cancer, viruses, and metabolic diseases. Recently, the US Food and Drug Administration approved a Roche product Xofluza, a treatment for Influenza for children aged five and under.

Roche’s CEO is Thomas Schinecker, newly appointed in March this year. Meanwhile, former CEO Severin Schwan will serve as the company’s new chairman. The company is based in Basel, Switzerland. Roche’s competitors include the likes of Novo Nordisk, Novartis, and Pfizer. In 2022, Roche reported a revenue of $69.608B, a decline of 3.38% from 2021.

Takeaways

The above introduction to the top 10 largest non-US companies by market capitalization should be used as a stepping stone for future research in order to make effective investment decisions. It is crucial to have as rich an understanding as possible of the global financial landscape before making any financial decision, to gain an understanding of the potential benefits and risks of certain non-US companies.

This information can also be especially helpful to your trading activities. By learning about global companies, you can trade, and understanding how their stocks move, you can effectively trade them on platforms like MetaTrader 4 (MT4). MT4 is an easy-to-use trading platform that is widely adopted by traders across the world, both beginner and advanced. Track the stocks of these companies on MT4, and trade them when you find the opportunity.

If you liked this post, you might also want to check out our other articles:

- Top 10 Largest US Companies by Market Capitalisation

- 10 Biggest UK-based Companies

- Africa’s Top-10: Leading Companies by Market Capitalisation

- Top 10 Largest Latin American Companies

- Economic Powerhouses: Trillion-Dollar Companies Club

Also, we recommend you find out more about global economies with our Trader’s Guide to the 10 Major Global Economies by GDP.

[1] Information on market capitalisation found at https://companiesmarketcap.com 19/06/2023